BNPL - Splitpay

Enable your customers to split their purchases into easy installments

With Splitpay by Solaris you can enable your customers to convert their payments into simple installments with a tap of a finger. Whether you are a merchant, an e-commerce shop, or a digital bank, our white-label buy-now-pay-later solution integrates smoothly with any frontend.

How it works

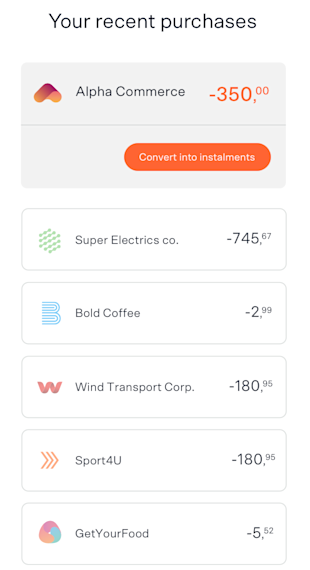

Your customer picks a payment to convert

Your customer selects a purchase starting from as little as 100 Euros which they’d like to split into smaller installments.

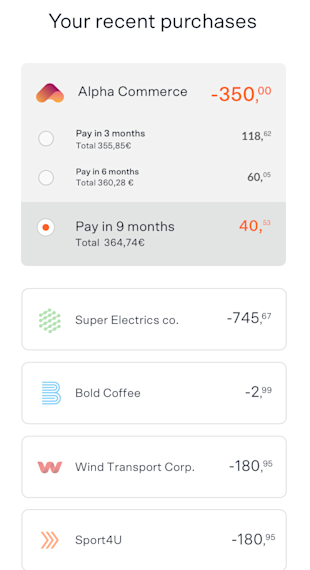

Your customer chooses a flexible repayment plan

Your customer can view the different repayment plans and set their preferred plan flexibly from 3–36 months.

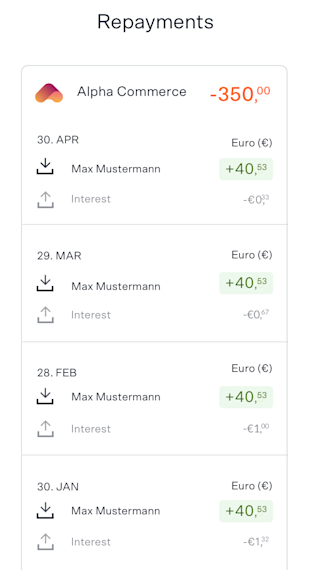

Your customer has full transparency and freedom

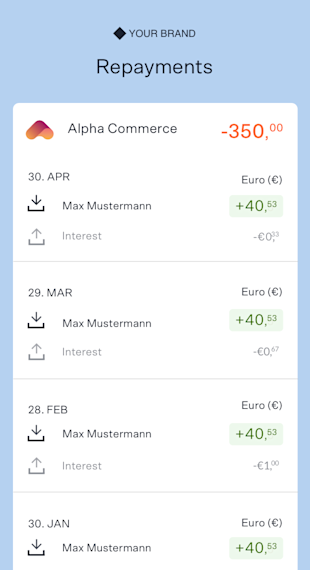

With Splitpay, your customers get the full transparency on their regular repayments. If they wish to split up more purchases - no problem! Your customers can re-use their Splitpay line whenever and wherever they like.

Your customers. Your brand. Our tech.

Our lending APIs nestle themselves neatly behind your frontend, allowing the entire user-experience to remain in your look and feel.

Splitpay offers a variety of flexible use cases before, during and after purchase

Top-up

Enable your customers to pre-fund their card or bank account before making a purchase and pay back in installments.

Post-purchase

Convert online banking or outbound card payments to installments

E-commerce realtime

Enable your customers to opt for paying in installments directly at the point of sale by integrating Splitpay into your customer journey.

Give your customers the full control

The fully digital application process with integrated video identification takes only a few minutes to complete. Once the application is confirmed, your customers can pay purchases starting from as little as 100 Euros in easy installments. The best part? Splitpay can easily be combined with our white-label bank accounts and cards, enabling you to offer your customers a fully fledged banking experience.

Stay on the safe side

With Splitpay, you own the entire customer journey. As a tech company with a full German banking license, we enable you to integrate the entire lending process directly into your front-end via API. We take care of scoring, identification (KYC), risk, and repayment management in the background – fully automated and compliant. This way, you can focus on your customers’ needs and leave the regulatory tasks up to us.