Empowering you to offer embedded financial services

Our Banking-as-a-Service platform has everything you need to build your own banking products.

Trusted by innovators across Europe

Europe's leading embedded finance platform

Solaris is a German technology company with a full banking license, enabling us to seamlessly operate in all financial areas across Europe.

With our cutting-edge APIs, businesses can effortlessly embed compliant digital banking services into their products and unlock new market potential. We combine the best of technology and banking, handling all regulatory complexities – so our partners can focus on what truly matters: their customers.

About usOur solutions for your embedded finance needs

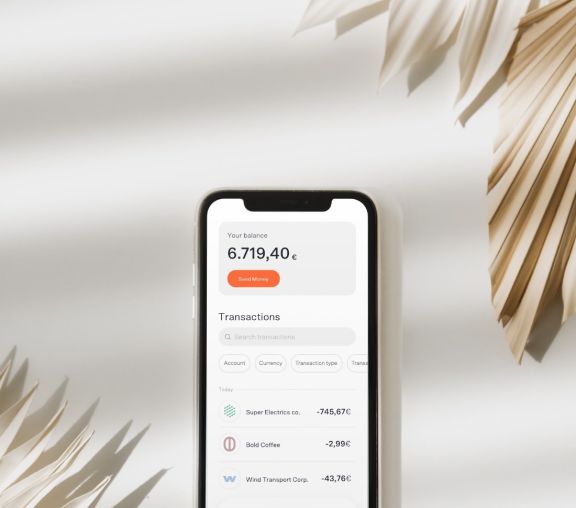

Digital Banking

Provide checking, savings, sub-accounts or multi-accounts on your brand. Support consumers, freelancers, and businesses with local or virtual IBANs.

Identification

Onboard individuals, freelancers and businesses in minutes with fully digital, secure, and compliant KYC (Know Your Customer) and KYB (Know Your Business) flows.

Cards

Unlock the potential of debit, prepaid and credit cards - Issue and manage physical or virtual cards for any customer segment.

Payments

Enable your customers to send or receive payments with SEPA Credit Transfer, SEPA Direct Debit, SEPA Instant or Batch Payments.

Lending

Offer paperless, fast, and mobile lending options in your own branding with overdrafts, installments (Splitpay) and consumer loans.

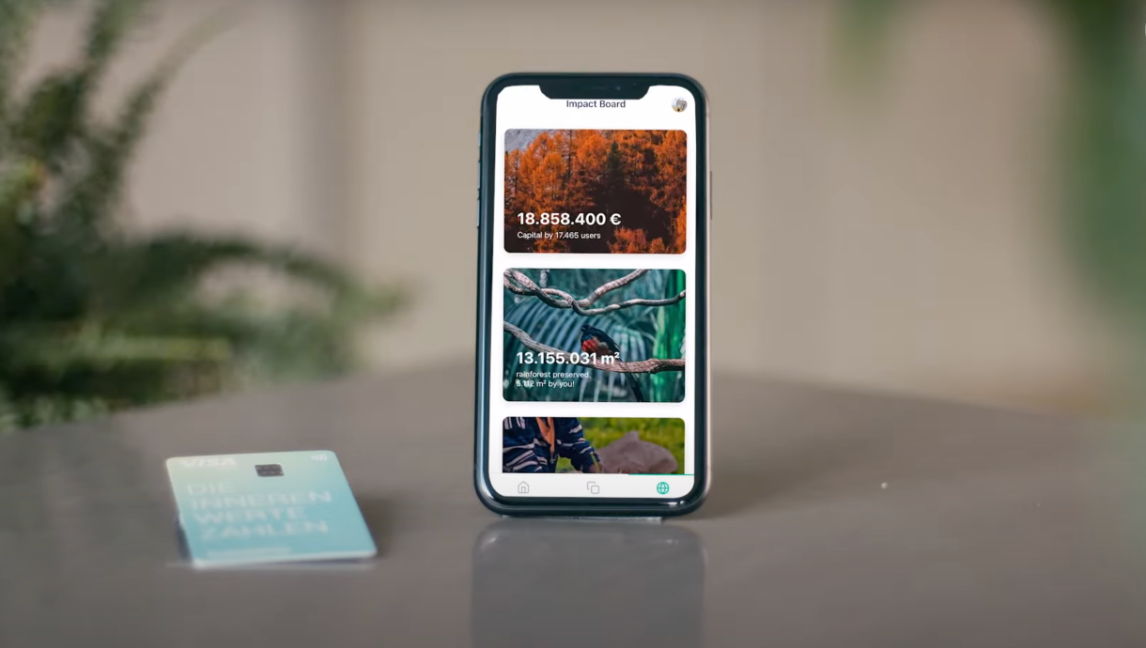

Banking tech reimagined

Cutting-edge technology

Our unique Banking-as-a-Service platform has some of the most advanced RESTful APIs in the European market. Our APIs are designed for scalability and international expansion.

Cloud-based banking

Our entire banking infrastructure is cloud-based. This way we create exceptional banking experiences for our partners' customers. We are leading the development of innovative and truly digital financial products.

Powerful APIs

With our smart API accessible services, you can easily manage the data of your users in real-time throughout the entire customer lifecycle: from onboarding to long-term support.

Data Mesh Architecture

Take advantage of our state-of-the-art data mesh architecture to leverage essential data for decision making, planning, forecasting, and regulatory compliance.

Why you should work with us

Neutrality

As a B2B2X platform, Solaris is always a neutral partner and never competes for customers. All products are adapted to the brand design of our partners.

Speed & flexibility

Our platform approach ensures fast and easy product customization, resulting in superb customer-centric financial features with minimal time-to-market.

Increased customer loyalty

Integrate financial services into your product landscape and increase customer loyalty with this service. Financial features that are customized are the perfect add-on to be remembered as a brand.

Fully licensed bank

With our German banking license, we can operate in all EU countries. We always take care of all regulatory complexities so you can focus on creating the best product for your customers.