Cards

Launch cards customers use daily

Create fully branded globally accepted payment cards – virtual, physical, or tokenized – backed by a licensed German bank. Offer prepaid, debit, or credit cards for consumers, freelancers, or businesses.

Solaris handles the regulated infrastructure and compliance so your team keeps control of UX, data, and insights.

Why our cards offering is end-to-end

Branded cards

Launch cards that match your brand – design, preferences, and UX – through our cloud-native API. Solaris covers regulated operations and keeps security tight.

Customer segments

Support consumers, freelancers, and businesses with configurable card options designed for all user profiles.

Card types

Offer physical, virtual or tokenized cards across credit, debit, or prepaid – tailored to your business, customer, and risk policy.

Account-linked or standalone

Issue cards with or without an underlying account to meet your customer requirements and onboarding flow.

Multi-currency ready

Enable global spending with cards that support multi-currency transactions worldwide.

International acceptance

Issue on Mastercard and Visa for broad acceptance and reliable payment processing worldwide.

Premium materials

Elevate your cardholder experience with eco-friendly and premium materials — from classic to metal.

Debit cards that drive everyday spend

Deliver familiar, account-connected debit cards from Visa or Mastercard for everyday expenses, with balance checks, ATM withdrawals, and optional overdraft.

Powered by Solaris’ secure platform, your cards offer global acceptance and full spending control for your customers.

Prepaid cards for controlled budgets

Issue globally accepted prepaid cards with fixed, preloaded funds – no bank account opening or credit check needed. Making issuance fast and simple.

Ideal for employee expenses, benefits, meal allowances, and other incentives. Solaris provides fast issuance and robust controls.

Credit cards for more flexibility

Offer charge or revolving credit cards with spending limits based on credit scoring. Tie usage seamlessly to loyalty and rewards programs to boost retention - stand out with comprehensive card benefits.

Solaris supplies secure risk tooling and the global acceptance your program needs.

Hear what our partners have to say

Explore our top card features

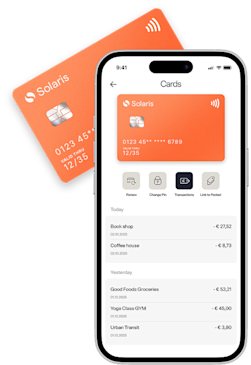

Card management

Control the full card lifecycle, adjust limits with ease and get real-time account updates via webhooks. Access detailed data via our user-friendly web portal – making card administration simple and efficient.

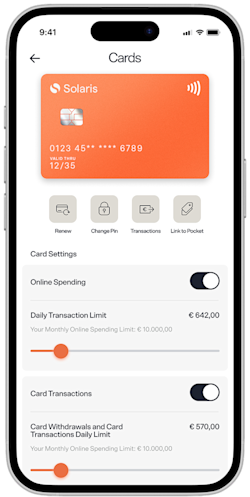

In-app card controls

Let cardholders control key card features directly in the app including blocking cards, spending limits and blocking foreign transactions. They can also request new cards and toggle online payments providing full card management anytime, anywhere.

Card security

Protect transactions AI-driven fraud detection, real-time risk management, and security alerts for instant activity verification. 3D Secure adds an authentication layer to protect online payments and keep cardholders safe.

Loyalty & rewards

Create tailored loyalty programs for credit card holders. Reward customers with bonus points, vouchers, fee discounts, or insurance benefits, to increase engagement and lifetime value.

Card rules, your way

Configure controls without extra integration: block or allow transactions by merchant category code, country, or payment method, and apply dynamic spend limits by volume or frequency.

Controls can work together for precise outcomes – ensuring flexibility, compliance, and security.

Standalone or integrated financial solutions

Standalone product

Start with branded card solutions that are easy to implement, providing your business with a quick entry point into the payments ecosystem. A standalone product is perfect for introducing financial services to your customers.

Combined solutions

Create a powerful financial suite by combining cards with identity solutions, accounts, and flexible credit options like overdrafts. This integrated approach streamlines onboarding, enhances user experience, and drives customer loyalty and growth.

Key business benefits

Full ownership with bank support

Keep full control of your branded card program with a German bank. You own the front end and Level-1 customer support. Solaris handles disputes, chargebacks, compliance, and regulated operations.

Boost brand engagement

Create daily customer touchpoints beyond payments. Provide personalized cards to strengthen brand loyalty and keep your business top of mind with every transaction.

Unlock new revenue lines

Tap into the growing card payments market. Launch card programs to generate new revenue through fees, services, and increased customer spending.

Gain insights from transactions

Leverage card transaction data to understand customer habits and enable smarter, data-driven business decisions.