Bankident

Identify your customers in the blink of an eye

Boost your KYC conversion rates by integrating Bankident into your sign-up flow. No agents. No waiting lines. Full compliance with German anti-money laundering laws.

Love at first byte

You never get a second chance for a first impression. Bankident does not require any face to face interaction, so your customers can identify themselves 24/7, wherever they are, in a matter of seconds. A digital onboarding experience that markedly boosts conversions while staying fully compliant with German and EU anti-money laundering laws.

How does it work?

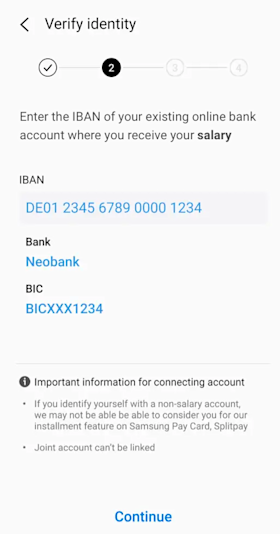

Your customer enters their personal data and provides their reference bank account.

Hear what our partners have to say

“The combination of technological and regulatory know-how for a fast and compliant product development has made a lasting impression on us.”

President of Samsung Electronics GmbH

Your benefits

Lightning Fast

With Bankident there are no compromises. Our fastest identification to date was completed in 47 seconds and still fulfills all the requirements of the German Anti-Money Laundering Act.

Scalable

No waiting for agents, 24/7 availability. With Bankident you can identify thousands of customers simultaneously, allowing your business to scale without limits.

State-of-the-Art

State-of-the-art APIs: We embed our modern RESTful APIs neatly into your front-end. Enabling you to own the customer journey from start to finish, branded in your corporate identity.

Mix and Match

With one single API, you have access to five KYC methods. We enable you to add other trusted KYC methods such as VideoIdent, PhotoIdent, and eID to our Bankident solution.