Wealth

Compelling digital services: Embedded finance is the next big thing in wealth management

Neobrokers, money management, private banking and trading companies can benefit from offering financial services. By expanding their digital services portfolio, businesses can retain customers in a changing industry, increase scalability and create new revenue streams.

Solaris' digital banking solutions can be natively integrated into platforms of all types and give wealth players a significant first-mover advantage that sets them up for long-term success.

Changes in customers trigger market opportunities

Younger, more digitally savvy and diverse customers are changing the way wealth management businesses operate. They expect lower entry barriers, digital-first onboarding, and user-friendly interfaces through their existing trading apps.

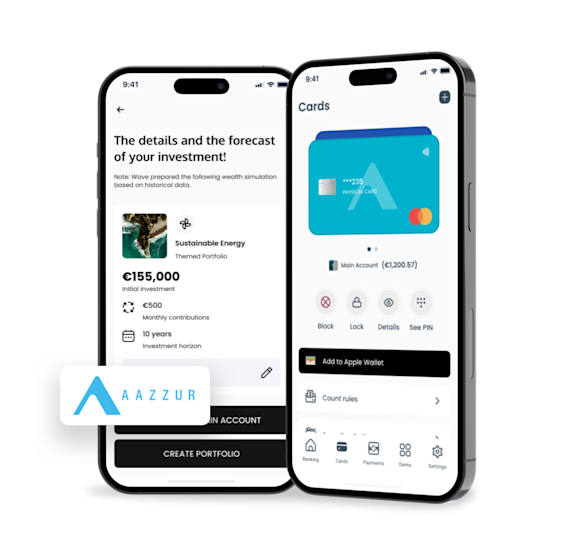

For Martin Damaske, co-Founder of AAZZUR, "the industry's most important drivers are AI identified customer journey data, multi-channel approach connecting advisors to customers, and digital services. Orchestration and delivery of great UX so investing is “easy as pie” is key to success."

Embedded digital financial services can help wealth players prepare their business to scale, build new revenue streams, boost new customer acquisition and engagement, keeping them relevant in the market.

Wealth management and financial services

While creating digital solutions from scratch can be costly, Solaris’ embedded financial services can be easily integrated to businesses via APIs so customers can manage their funds via mobile and web devices.

Know-your-customer (KYC) solutions help speed up the digital onboarding process, digital bank accounts support an easier flow of funds and co-branded credit or debit cards enhance a wealth brand’s daily engagement with customers.

With these digital financial solutions, wealth management businesses can outperform competitors and stay ahead in the market, increasing customer retention and acquisition rates.

What a partner can expect to receive

Scalable Onboarding

Offer flexible and customer-friendly methods of KYC (know-your-customer) identification and fasten the digital onboarding process to happen in under 3 minutes.

Revenue diversification

Create new business opportunities with digital bank accounts, credit or debit cards, and diversify your revenue streams to ensure market consolidation.

Leveraged data

Payment or card data is a valuable source of information about customer behavior. Analyze anonymized customer purchasing behavior to provide better-suited products.

Increased stickiness

Drive brand loyalty and customer engagement by expanding touchpoints. Customers will interact with your brand whenever they use your embedded finance products.

Wealth success stories

Coinbase: One platform – different KYC methods

Coinbase is one of the largest cryptocurrency platforms in the world, is a driving force in the crypto industry and a role model for customer-centric product development.

With the help of Solaris, Coinbase customers can choose between Bankident or video identification to identify themselves in under 3 minutes. Solaris' KYC Platform enables increased conversion rates and a frictionless onboarding experience.

Hear what our partners have to say

“Thanks to the Solaris platform, we are now able to provide our customers with a range of identification options that are not only secure and compliant with local regulations but also seamlessly user-friendly.”

Managing Director of Coinbase Germany GmbH

Explore key insights - discover our wealth management whitepaper

The wealth management sector is undergoing a profound transformation. Over the next 20 years, we will witness what has been called "the greatest wealth transfer in history."

Wealth management customers are becoming progressively younger, more digitally savvy, and more diverse. Wealth management firms who seize this new customer demographic opportunity and launch digital embedded finance products today can gain a significant first-mover advantage that sets them up for long-term success.

What we recommend for wealth management players

Cards

Cards are a great embedded financial feature with huge potential for wealth management brands.

Enrich your customer's banking experience with your co-branded payment card. By offering a seamless banking experience, your customers engage with your brand every time they make a payment.

Bank accounts

At the heart of the financial ecosystem lies the bank account, a fundamental element driving customer relationships. With the power to strengthen customer loyalty, it can be a great product to elevate customer experience.

Wealth management providers can leverage its capabilities with powerful financial insights on customer behavior and new streams of revenue.

KYC

Scaling customer onboarding while still staying compliant with all local and EU anti-money laundering laws doesn't need to be complex.

By choosing a digital KYC platform and offering a range of identification methods, brands can wow customers and boost onboarding conversion rates.