Software Providers

Embedded finance: A game-changer for SaaS companies

Increasing NPS, improving CAC:LTV ratio and preventing churn. These are common challenges for Software-as-a-Service and tech companies.

Reaching all these goals while constantly adapting the service to keep ahead of the competition is no easy task. Especially, if you are providing financial management solutions, accounting services, ERP or HR software. The strategic imperative: creating a frictionless user experience to improve conversion rates and tap new sources of revenue.

Embedding financial services can be a next-level advantage for SaaS players. Solving customer pain points with bank accounts, payments, co-branded debit, credit or prepaid cards, and KYC or BKYC solutions.

Smooth financial processes for SMEs and freelancers

Freelancers and SMEs often need to monitor their finances across various banking providers to manage expenses and payments. Incorporating banking services into their platform allows SaaS and tech companies to remove that stress from the equation and unify the financial journey.

Enabling customers to send and receive payments via SEPA direct debit and credit transfer, SEPA Instant, or to carry out peer-to-peer transactions, enhances the value proposition of SaaS companies by adding highly desirable payment options that complement their core offering.

Building financial ecosystems for SaaS and tech customers

Combining the reach and innovation of tech companies with the expertise and regulatory know-how of Solaris is the optimal constellation for swiftly building a financial ecosystem for customers.

Establishing an unified payment processing system and offering customers a single financial home on their platform sets leading software companies apart from the competition.

What a partner can expect to receive

Reduced friction

Simplify your customers' financial management. Integrated bank accounts and cards make it easier to manage payments and settle expenses.

Increased customer loyalty

Increase customer loyalty and retention by adding touchpoints. Customers interact with your brand whenever they use your embedded financial products.

Revenue diversification

Create new business opportunities with digital bank accounts and co-branded payment cards. Diversify your revenue streams to strengthen your market position.

Scalable Onboarding

Offer flexible and customer-friendly identification methods (KYC). Leverage digital onboarding processes for outstanding customer experiences.

Unlock SaaS growth – discover our guide

The SaaS industry will reach USD 1.23T by 2032, and SMEs, who demand finance features inside software, will drive this growth.

Our new guide shows how to reduce churn, streamline operations, and increase EBITDA by 20–30% with embedded banking products.

Learn about compliant setups, data-driven use cases, and go-to-market steps for SaaS leaders.

Top three banking features for SaaS platforms

Cards

Payment cards are a smart financial feature with great potential for SaaS and tech companies.

Enrich your customers' banking experience with your co-branded prepaid, debit or credit card - physical or virtual ones. By providing a seamless banking experience, your customers engage with your brand every time they make a card transaction.

Unlock the benefits of payment cards for your customers today

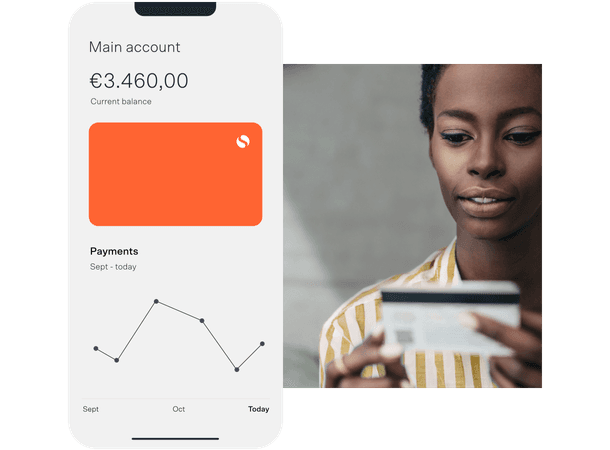

Accounts

Bank accounts are a fundamental element of customer relationships. Centralized on one platform, it can be a great product for freelancers and SMEs to make the customer experience seamless.

SaaS and technology companies can leverage its capabilities with meaningful insights into customer behavior and new revenue streams.

Discover the potential of better banking for your customers now

Payment Flows

Companies need a fast and secure payment infrastructure to maximize acceptance while minimizing processing charges – regardless of country, currency or payment method.

Our APIs enable businesses to offer their customers payment options that allow them to move their funds wherever and whenever they want, in compliance with anti-money laundering and fraud detection.

Deliver faster payments to drive a seamless financial experience