Case Study

GroverPay, earn, and own the tech experience with Grover Card

As a global market leader in technology rentals and a pioneer in the advancement of the circular economy, Grover enables people to subscribe to tech devices on a flexible monthly basis instead of purchasing them. With Grover, subscribers gain access to thousands of tech products allowing them to keep, switch, return, or buy depending on their individual needs and budget. As of June 2022, Grover has rented out 845,000 devices.

Challenge

To give customers even more access to tech, Grover sought to launch a B2C debit card, aptly named Grover Card, as the first of its embedded financial features to enhance the customer experience. However, launching any regulated financial services product in Germany poses a number of challenges:

-

The German regulatory framework requires a banking license to provide bank accounts and payment cards to customers. Obtaining a banking license requires significant time, effort, and money. This led Grover to look for a reliable partner who could embed financial services into its core offering.

-

Given the fast-paced nature of the market, Grover looked for a partner who could enable their embedded finance proposition with seamless API integration. Furthermore, the card API needed to give customers full control by allowing them to individually block and unblock their cards and set personal card limits.

-

Since many Grover devices are leisure-based, it was necessary to integrate some clever features into the Grover App that would form an ecosystem around the platform and increase customer loyalty in the long run.

Our solution

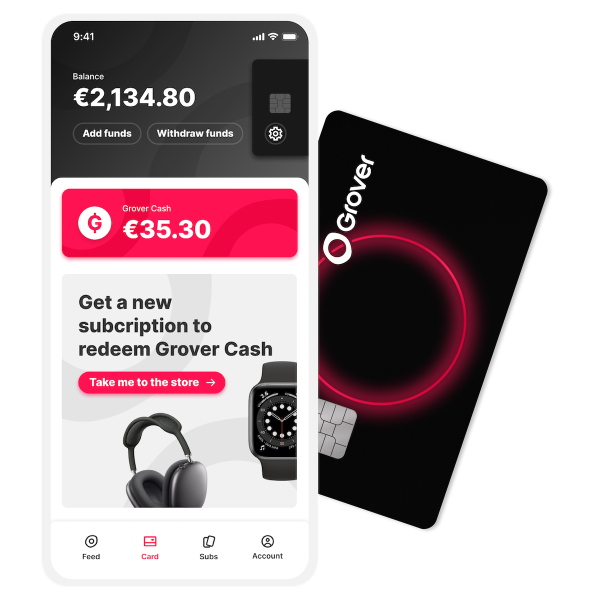

Grover Card - elevating customer experience

The launch of the Grover Card, a Visa debit card issued by Solaris, focuses on increasing customer engagement and retention, while at the same time offering a platform that would support other value-added financial services in the future. Grover Card allows customers to pay securely, anywhere in the world where Visa is accepted, with the same level of protection and security offered by all Visa products.

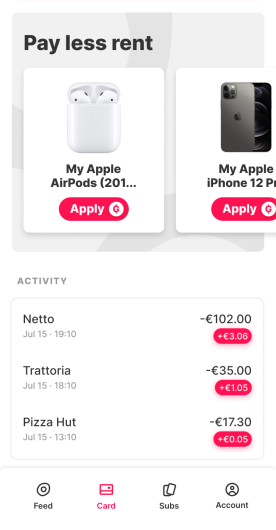

Unparalleled banking experience

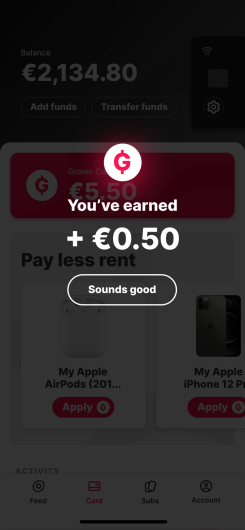

Grover Card is the only card that encourages customers to convert their daily spending into tech rentals, all through a gamified rewards program with 3% cash back in Grover Cash, Grover’s proprietary currency, on every payment. Customers can thereby reduce or even fully cover their Grover tech subscription. Paying with Grover Card is designed to feel playful, rather than strictly financial. Customers can invest their newly-earned Grover Cash in the tech they love, whether that’s the latest iPhone or an e-scooter.

The initial results

Upon the beta completion phase of Grover Card, user engagement data showed clear promise with the following:

-

A significant share of Grover's active users in Germany have already applied for official access to the card itself.

-

Approximately 60% of Grover Card users who made payment also began a new Grover subscription within 90 days.

-

Grover card users tended to rent more tech devices for longer periods of time than non-card users.