Case Study

CoinbaseA driving force in the crypto industry

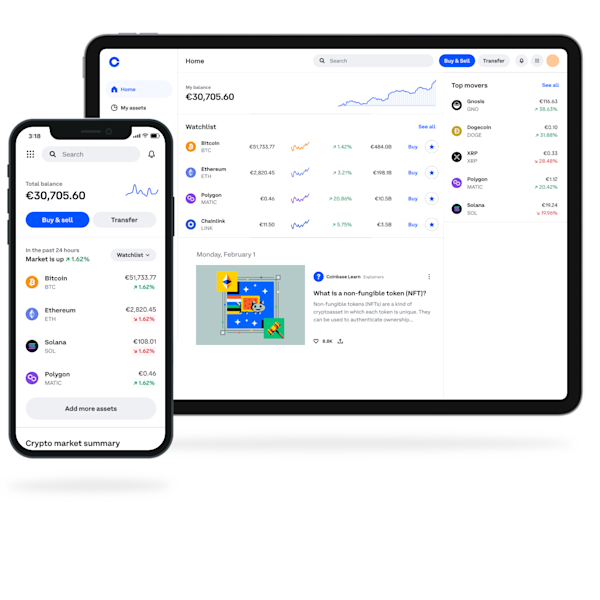

Coinbase is one of the largest cryptocurrency platforms in the world. Consumers, institutions, and businesses can trade hundreds of cryptocurrencies and easily and quickly exchange them for fiat money. The platform offers personalized support and, of course, secure storage of digital assets. They made digital currency accessible for everyone and are one of the most trusted and easy-to-use platforms for accessing the broader crypto economy. Coinbase is a driving force in the crypto industry and a role model for customer-centric product development.

Challenge

In 2021 Coinbase Germany GmbH as part of the Coinbase Group entered the German market and was the first to receive the corresponding trading and crypto custody license from the financial regulator BaFin. But, next to obtaining a license for crypto trading, it requires more to meet the full regulatory framework for financial services and operate compliantly:

- Identifying and knowing your customer was the next challenge after getting the crypto-custody license. Therefore, Coinbase needs to identify and verify their customers according to German know-your-customer (KYC) standards – this is mandatory for all financial service providers. Coinbase needed an authorized partner with a bank license to help identify customers, compliant with the anti-money laundering (AML) laws in Germany.

- Since customers have different preferences and do not want just one identification option, a single authorized partner had to provide multiple solutions to innovate the onboarding flow.

Our solution

One platform – different KYC methods

Solaris KYC platform offers the easiest ways to identify customers. Partners can boost their conversion rates by integrating their sign-up flow with Solaris’ fully digital Know-Your-Customer Platform, all while staying compliant with EU anti-money laundering laws. One of the most widespread methods in Germany for KYC is video identification, where a customer chats with an agent via video and presents an ID document. Another identification method is Bankident, which offers many advantages.

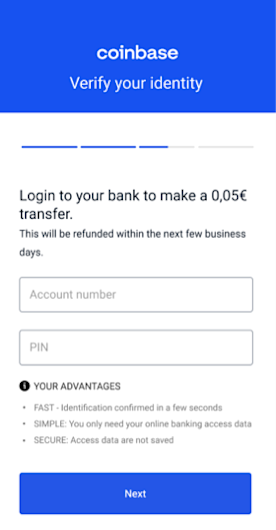

Bankident – state-of-the-art digital identification

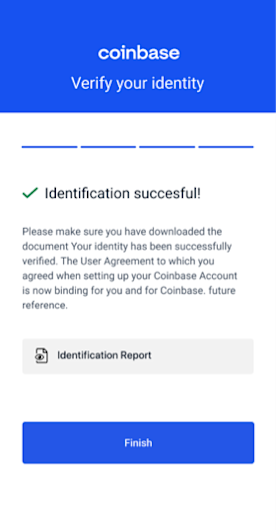

Bankident does not require face-to-face interaction with an agent, it enables a faster and unlimited scalable identification process – compliant with German AML law. With Bankident, Coinbase users can identify themselves in minutes since Bankident works in three easy steps. First, personal details are entered, then the account is confirmed by IBAN and checked for authenticity by Solaris. In the last step, a euro amount is transferred to Solaris and the verification is completed through a qualified electronic signature (QES).

Innovation of the onboarding flow

The process via Bankident is completely digital, available 24/7, and reduces the onboarding time. As a result, Coinbase customers can identify themselves in under 3 minutes, enabling increased conversion rates and a great customer experience.

With the implementation of the proprietary KYC platform from Solaris, Coinbase now offers its customers a frictionless onboarding experience and a choice between Bankident and video identification.

The project in numbers

- <3minutes needed for the fastest identification

- 2different KYC methods to choose from (Bankident, Videoident)

What they say about us

“Thanks to the Solaris platform, we are now able to provide our customers with a range of identification options that are not only secure and compliant with local regulations but also seamlessly user-friendly.”

Managing Director of Coinbase Germany GmbH