Why the next generation of challenger banks must serve niches

6 minute read

When the first neobanks launched in the early 2010s, their main selling point was a radically better customer experience.

Where incumbents were clunky, inflexible, and frustratingly bureaucratic, the likes of Monzo, Revolut, and N26 were a breath of fresh air: faster, more convenient, and all digital. Plus, they charged lower, more transparent fees.

Fast forward ten years, and the gap has narrowed significantly. Incumbents' apps are catching up. And some banks, like Goldman Sachs, have launched their own, wildly successful digital-only offshoots.

Challengers, while certainly successful, have yet to displace their incumbent cousins. While their growth rates continue to climb in all respects — a 2019 report reckons neobanks will have 85 million customers by 2023 — profitability is still out of reach for the majority. Only few are profitable today.

What does this mean for neobanks? Is it time for them to try a different approach?

Is building apps for the mass market and seeking growth at all costs still the key to success? Or does the next wave of opportunity lie in vertical banking — building a high quality but narrowly-targeted product?

What is vertical banking?

Vertical banking means delivering a highly personalized banking experience to a very specific type of customer. Where the usual approach is to supercharge an existing banking product with technology, vertical banking does the opposite. The aim is to create a product that meets the unique needs of a tightly-defined audience.

Case in point, Tomorrow appeals to ethically-minded people by investing deposits in renewables and social initiatives, as well as offering features that help them reduce their carbon footprint.

Or consider even nichier apps such as Squire, who bundle a payment solution with financing, a virtual point of sale, appointment scheduling, and further features specifically for barber shop owners.

This kind of specialisation isn't a new idea.

When Amadeo Giannini founded the Bank of America in 1904, for instance, his aim was to cater to the Italian immigrant community at a time when banks were only interested in big businesses and high net worth individuals.

Similarly, credit unions have been serving local communities and people with common interests since the mid-1800s.

But vertical banking goes much deeper. Alongside general characteristics like demographics and geography, it also targets psychographic traits — a shared lifestyle, shared attitudes, or shared beliefs.

Take Bella, for instance. This neobank offers a feel-good experience for socially-minded customers. Users can collect “Karma points” by paying the tab for another user or donating cashback earnings to charitable causes.

Technical excellence is no longer enough

"The most compelling reason for neobanks to go niche is that being digital-first is no longer a key differentiator."

Digital transformation has been at the top of incumbents' agendas for years. And the Covid-19 pandemic has skyrocketed their progress, with experts reckoning the industry has achieved in months what would've taken a decade under normal circumstances.

Concurrently, banking-as-a-service providers have levelled the playing field for new entrants. Where the first generation of challengers had to build their own technology stacks from scratch, today's neobanks don't have to. They can rent out banking infrastructure from a specialist provider and launch faster and at much lower cost.

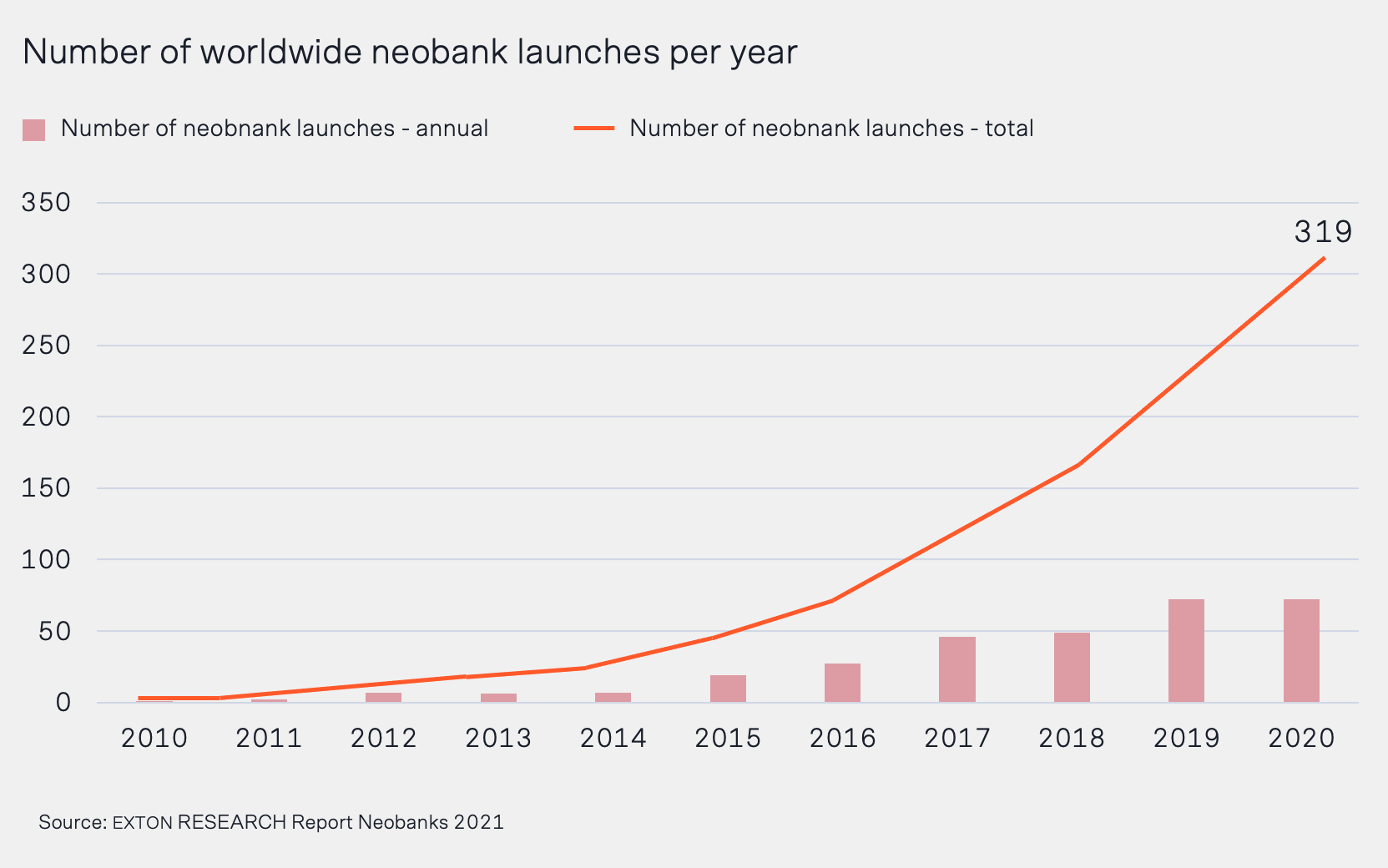

The upshot is that the barriers to entry have never been lower. But, in turn, expectations have never been higher. With over 250 neobanks currently on the market — all of which offer similar services and have comparable security, speed, and user-friendliness — customers are spoilt for choice.

So, the real question is no longer whether a particular neobank can do banking better than an incumbent.

It’s how much value it can create for the customer.

Chasing unicorns

Low barriers to entry and sky-high customer expectations aside, there's another compelling reason for neobanks to specialise: it can help them reach profitability sooner.

First generation neobanks have made growth their top priority. But with the market for digital-only banks close to saturation point — and because customers tend to use neobanks as their secondary accounts — growth has never been enough to outpace the high cost of customer acquisition.

It's fair to say that the average challenger bank has always accounted for the fact that customers would use their accounts for secondary reasons like travel and entertainment. The strategy has always been to get a foot in the door and persuade enough customers to switch over the long term.

The problem with this model is that its success rests on reaching critical mass. That was a realistic proposition in 2011, when incumbents' digital ineptness gave challengers the edge. But now that being digital-first is no longer a USP, it's an increasingly hard sell.

To make matters worse, people have been traveling and socialising much less than usual due to Covid-19 restrictions. And this means less income from important revenue streams like debit card interchange fees and commissions. As a result, the losses are stacking up.

Beyond banking

In comparison, the vertical banking model doesn't have to rely on growth at all costs to achieve profitability, because the USP isn't the core service — a digital-first account — but the suite of services that are bundled with it.

Consider Kontist, who offer a business bank account tailored specifically for the needs of freelancers.

Any fintech can create an account that lets you make and receive business payments. What sets Kontist apart is the highly valuable ecosystem it creates for busy freelancers.

For instance, Kontist offers an automated bookkeeping service that syncs the user’s bank account with their accounting tool in real time. Kontist then automatically calculates the expected income and sales taxes to help freelancers keep an overview of their bottom line. Further features include the ability to create invoices directly out of the account, as well as an integrated tax advisory service.

These thoughtful add-ons solve big pain points, save time, and, potentially, save money, because customers won't have to buy expensive standalone software.

Research has found that customers are willing to pay up to 20% more for a highly personalised product. So, offering valuable add-ons tailored to a very specific type of customer is a golden opportunity to cross-sell and diversify revenue streams right out of the gate.

At the same time, a more homogenous user base makes it easier to evaluate credit risk effectively. And this means specialized neobanks are better placed than their first-generation counterparts — or even incumbents — to offer lending products at attractive rates. And lending is not only a lucrative revenue stream. It also ties customers to their bank for a longer period of time.

Most importantly, engagement and, in turn, loyalty are likely to be higher when the product matches a customer's lifestyle.

Fea Money, for instance, is designed specifically for women — a category of customers that are often short-changed by traditional financial services. Their products include an account specifically for mothers, as well as financial coaching and access to grants for female entrepreneurs.

Similarly, Daylight offers LGBTQ+ customers specialized financial coaching and features, including cards in their preferred name, while Insha gives Muslims access to financial products that are compatible with their values and faith.

The future is vertical

By 2028, the neobank market is expected to grow to $722.60 billion (around €593.62 billion). But, as Starling Bank's CEO Ann Boden noted in her 2020 letter to investors: 'Growth is one thing. But achieving sustainable growth is another.'

"There's still plenty of room for neobanks to carve out market share. But only if they stop trying to be everything to everyone."

If they want customers to stick with them, they need to focus on creating innovative financial products that improve their customers' lives and address the specific problems incumbents can't solve.

How do we get there?

Identifying a niche in need of tailored banking services is one thing, but delivering a reliable and compliant service to them is another.

Banking-as-a-Service (BaaS) platforms can play an important role in accelerating the vertical banking wave by lowering the barriers to entry. Instead of building an entire banking infrastructure from scratch and becoming a licensed institution, vertical banks can simply build on top of the API-based BaaS platforms that already provide the modular banking services out of the box.

With a BaaS player doing the heavy lifting in the background, vertical banks can launch their product in a fraction of the time, massively reduce their overhead investment and, most importantly, focus on building the value-added services that differentiate their product in the market.

The possibilities for vertical banks are endless. Now, its up to Banking-as-a-Service players like Solarisbank to provide the technology that meets the requirements of this new age of banking.