Supercharge Business Growth: Why ERP Providers Need Embedded Finance in 2025

4 minute read

The Enterprise Resource Planning (ERP) software market is huge.

On a global scale, it was already valued at $81.15 billion in 2024 and is projected to expand with a compound annual growth rate of 13.8% until 2032.

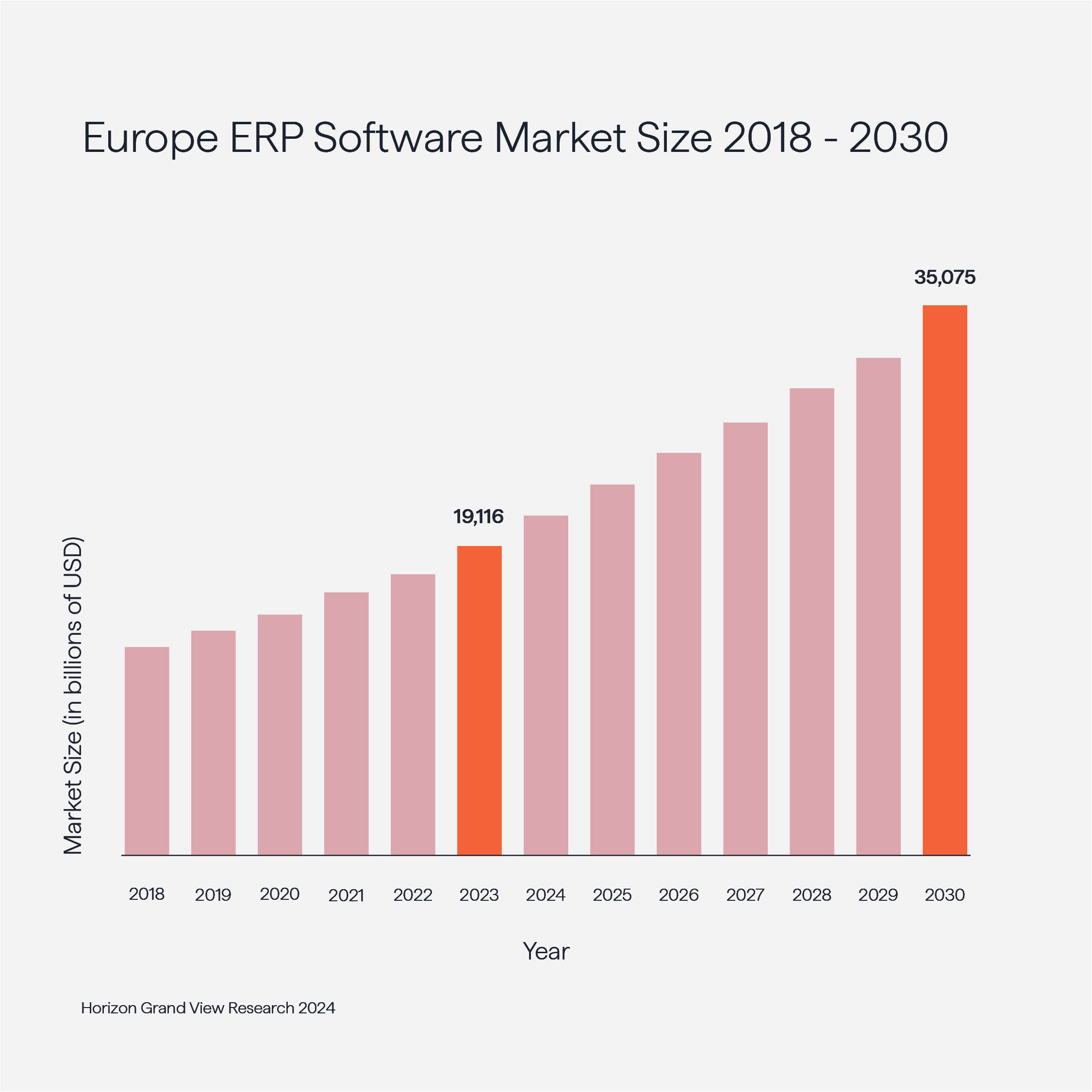

Official statistics from the European Union pointed out that in 2023, 43.3% of businesses in the EU used ERP software applications – and this number is growing. This corresponds to a value of the European ERP software market of $19.11 billion at the time of publication.

However, in the rapidly evolving business landscape of Software-as-a-Service providers, ERP vendors face mounting pressure to deliver comprehensive solutions that not only streamline operations but also enhance financial capabilities to keep customers on board.

This is especially true for cloud-based ERP vendors serving small and medium-sized enterprises (SMEs) and freelancers, as this target group is known for frequently switching to the software that best suits their needs and offers the lowest pricing.

There is plenty of competition, as ERP applications are the largest software subcategory, making up about 13% of the software market.

The integration of financial products, like business bank accounts or digital B2B payment cards into ERP systems has emerged as a pivotal strategy, offering a seamless fusion of everyday banking services within an existing ERP platform.

This approach not only elevates user experience – boosting productivity and decision-making – but also positions ERP providers at the forefront of market innovation.

With the integration of embedded finance products, ERP vendors could expect an EBITDA uplift of 20-30% within a 2-3-year timescale, as research suggests.

Avoid Operational Headaches

SMEs often struggle with the complexity of managing multiple provider relationships for essential financial functions such as accounting, invoicing, banking, expense management, and payroll.

More to the point, juggling these disparate systems creates inefficiencies, increases administrative burdens, and leads to errors in financial reporting.

One of the most pressing pain points for SMEs is reconciliation – manually matching transactions across different platforms is time-consuming and prone to mistakes.

By using banking services directly integrated into their ERP system of choice, SMEs can automate reconciliation, streamline operations, and eliminate the need for multiple logins and data transfers.

Furthermore, leveraging data from embedded financial services enables SMEs to take a crucial step toward strategic financial planning – predicting future trends and making informed decisions. This allows businesses to focus on growth rather than operational headaches.

The Rise of Embedded Finance in ERP Systems

The European embedded finance market is experiencing significant growth, with revenues projected to surpass €100 billion by the end of the decade. This surge is driven by technological advancements and evolving customer expectations, prompting businesses to adapt swiftly to remain competitive.

ERP vendors embedding financial services into their systems – allowing users to manage transactions, access credit, and oversee financial operations without leaving the ERP environment – are well-positioned to capitalize on this trend.

On the one hand, merging ERP and banking into a single interface keeps users on one platform, which is the smart thing to do. This not only saves time and reduces costs but also provides a clearer, real-time financial picture. On the other hand, it addresses the growing demand for unified solutions that enhance operational efficiency and user satisfaction.

It is not only an advantage for ERP vendors to offer clients integrated financial solutions that streamline processes and improve financial planning – it also solves one of the main pain points for SMEs: cash flow management.

Research suggests that 83% of SMEs want embedded financial services in their everyday applications to overcome inefficiencies in financial management.

Top 3 Benefits of Integrating Embedded Finance into ERP Platforms for SMEs

-

Enhanced User Experience: Business bank accounts integrated with ERP allow SMEs to streamline financial transactions, access financing options, and manage accounts – all within a single platform.

-

Optimized Cash Flow Management: Automate receipt collection and reconciliation with B2B payment cards. SMEs can streamline financial operations, enhance cash flow management, and reduce processing times with tailored card controls, transaction limits, and real-time tracking for more informed decisions.

-

Payment Processing Solutions: Integrating ERP systems with Europe’s leading payment network, SEPA, revolutionizes SME payment processes. This powerful combination enables seamless SEPA direct debit, credit transfers, instant payments, and peer-to-peer transactions. Fast payouts to suppliers and employees are guaranteed.

As Solaris' Chief Growth Officer, Riccardo Colnaghi points out:

The integration of embedded finance into ERP systems is revolutionizing the market landscape. By doing so, ERP providers not only enhance user experience but also unlock significant revenue streams. This strategy positions ERP vendors at the forefront of innovation, meeting the growing demand for seamless, all-in-one business solutions.

The Key for ERP Providers to Offer Financial Services

By integrating Solaris' embedded finance solutions, ERP providers can reduce friction for SMEs in financial management, increase customer loyalty through enhanced touchpoints, diversify revenue streams, and offer scalable onboarding experiences – a win-win for both vendors and their customers.

But there’s more. By offering B2B accounts, fast payment processing, and a compliant KYB solution, an average ERP platform can be transformed into a financial home for its users.

More precisely, ERP providers offering embedded finance solutions differentiate themselves in the market and gain a competitive advantage, attracting a broader client base seeking comprehensive, all-in-one platforms.

Incorporating financial services opens up additional revenue channels for ERP providers, such as interchange fees, interest shares, and service subscriptions.

To unlock all of the benefits of embedded financial and banking services for customers, one thing is mandatory: ERP vendors need a fully licensed banking partner to get access to various product options including lending solutions, ensure compliance with strict financial regulations, including AML and KYC requirements, and minimize legal risks.

The adoption of embedded finance is no longer a luxury but a necessity for those aiming to lead in 2025 and beyond.