Understanding KYB: What is it, and how do you do it efficiently?

5 minute read

Every business, regardless of size or industry, benefits from getting to know their customers.

But if you offer financial services products to corporate customers, understanding who they are — a process called Know Your Business, or KYB — is a strategic imperative. A process that's critical for preventing fraud, and identifying and minimizing risk.

Unfortunately, because it tends to involve a lot of manual labour, KYB, or business KYC, often becomes a time-consuming, unnecessarily demanding process that frustrates your customers and creates needless stress for compliance teams.

We're here to tell you that it doesn't have to be this way. In fact, when done in a streamlined way, KYB lowers risk and associated costs, and even boosts customer satisfaction and loyalty. Which is where Solaris comes in.

Here's a look at KYB — what it entails and the challenges it creates for businesses — and how the Solaris BKYC API can help you simplify the process at scale.

KYB vs KYC: What's the difference

While KYB and KYC are related concepts, they're not the same thing.

In KYC — know your customer — the focus is on verifying the identities and assessing the risk profiles of individuals. By contrast, KYB — or business KYC — focuses on verifying the identities and assessing the risk profiles of corporate customers and entities.

Think of it this way.

If you were a landlord with a portfolio of residential properties, KYC would be like getting to know a tenant before they sign a lease. You'd check they're actually who they say they are, whether they can afford the rent, and that they can be trusted to take care of the flat.

KYB, on the other hand, is like adding a new property to your rental portfolio. Here, you'd check that it's structurally sound and complies with city regulations, that the utilities are connected and work properly, and that the person you're buying it from has the legal right to sell it to you.

KYB compliance: How it works

Many major jurisdictions, including the US, UK, Germany, France, Italy, Japan, and Australia, as well as the European Commission and the Gulf Cooperation Council, are members of the Financial Action Task Force (FATF), which leads global action against money laundering and the financing of terrorism.

As a result, while KYB rules can vary slightly from one jurisdiction to another, the core principles of KYB remain consistent across the globe. The key elements of KYB compliance typically include:

-

Identifying and verifying the business and its ownership structure

-

Identifying and verifying the business' ultimate beneficial owners — the individuals who control the business. An individual is typically considered an ultimate beneficial owner if they own 25% or more of the business or can exercise control through other means, like side agreements or shell companies. In some countries, the threshold is lower. In the US, for instance, you're an ultimate beneficial owner if you own 20%

-

Assessing whether the business is, in fact, legitimate, by checking its history and financials for any red flags, such as odd or unusual relationships, sanctions, connections with politically-exposed persons, and any legal or reputational issues such as inclusion on adverse media lists

FATF recommends a risk-based approach to KYB, with more stringent requirements for businesses deemed "higher risk".

The flipside is that KYB isn't a once-and-done deal. Financial services regulators expect firms to keep a close eye on corporate clients on an ongoing basis, and ensure the information they have about them on file is always up to date.

The benefits of KYB beyond compliance

In 2023 alone, banks were collectively fined $835 million for KYB and KYC breaches.

And, while uncommon, jail time isn't unheard of. Earlier in 2024, for instance, the former CEO of Swedbank, Sweden's oldest bank, was sentenced to 15 months for making "misleading statements" in the press about a branch's compliance failings.

But while the consequences of non-compliance can undoubtedly be harsh, there are other very good reasons to have robust KYB processes in place.

For one, it helps minimize fraud and the risk of other financial crimes, such as tax evasion, money laundering, and the financing of terrorism.

These can be extremely costly both financially and in terms of reputational harm. Case in point, a scandal involving the creation of millions of fake current and credit card accounts has, to date, cost one of the world's largest banks over $2.2 billion in client refunds and lost business.

More significantly, though, KYB increases customer trust and frees up resources that would otherwise be tied up dealing with fraud and other issues.

The data collected from the KYB process is also a valuable source of insights that make it easier to deliver highly personalized products at the point of need. Products that give your business customers more value and, so, encourage them to stick around.

What firms often get wrong about KYB

According to Thomson Reuters, the average large financial services firm spends $150 million on KYB-related procedures and employs around 307 KYB professionals to handle the workload.

Yet, 85% of businesses report a negative experience, with the majority complaining it takes too long and causes needless friction. Needless to say, KYB is challenging to get right.

Credit referencing agency Experian estimates firms may need to collect as many as 150 data points when they conduct KYB. Business registration documents, senior management and ultimate beneficial owners' ID documents, financials, details of the decision-making and operational structure… the list continues.

And, the more complex a business is, the greater the time, effort, and cost of gathering this information and keeping it up to date.

But, if anything, this underscores the point. While hiring more staff to deal with the workload may address the symptoms, it won't solve the root cause of the problem — the complex and ever-changing nature of KYB requirements.

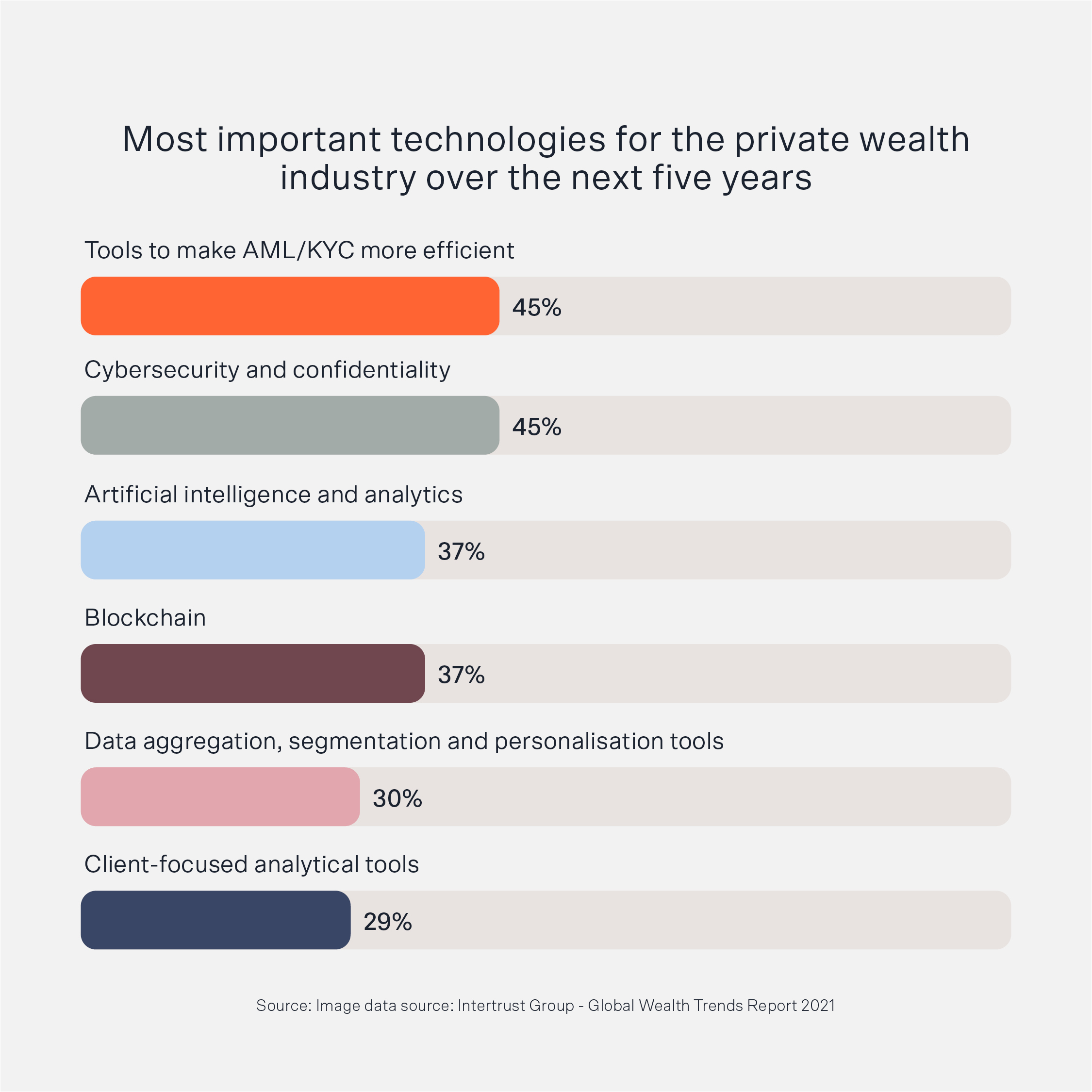

So, while it's important to have well-thought-out processes in place and a large enough team with the right knowledge and experience, firms also need tools that are fit for purpose. Technologies that can help them handle KYB efficiently and effectively, on an ongoing basis, and to do so at scale.

Simplifying KYB compliance, with Solaris' BKYC API

Solaris' business KYC platform simplifies both initial and ongoing KYB processes by bringing together integrated data collection and automated verification in a single, unified, user-friendly interface.

Our RestfulAPI can gather KYB data automatically — the customer enters their company name and country, and our platform will pull the information and documents required by the applicable local regulatory requirements from public databases.

Solaris' highly experienced compliance staff checks and verifies this information, which means you don't need to hire additional staff to handle your growing workload. Or pivot part of your operations to KYB compliance when your core business isn't financial services.

And, because all your KYB data and documentation is gathered in one place, you have a single, easily-accessible, trusted source of truth.

Our business KYC experts also check and verify senior management, ultimate beneficial owners (UBOs), and other individuals who control, are involved in, or can legally represent the business, for instance via side agreements and voting rights.

All in all, our platform and compliance experts dramatically reduce the onboarding process, from weeks or even months, to less than 48 hours.

KYB compliance is mandatory. A poor onboarding experience isn't

FATF updated its standards in 2023, and is planning a significant overhaul aimed at addressing technological developments like cryptocurrencies, as well as emerging threats.

The EU is also working on a significant overhaul, with the new rules bringing in more sectors in scope, introducing tighter requirements, and smoothing out differences between individual member states' laws.

But while KYC and KYB regulations are continuously evolving and getting more complex and stringent, there's one thing they don't do: require firms to create lengthy, hair-tearingly frustrating onboarding processes for their customers.

If anything, the easier it is for business customers to provide the right information — and for organizations to comply with regulatory requirements — the better it is for everyone.

Why take needless risks with time-consuming, resource-heavy processes that are prone to human error, when technology can make life easier and financial services safer?