The Viewpoint: What is embedded finance and how does it work?

6 minute read

With worldwide investment into embedded finance players hitting $3.1 billion, it's clear that this isn't just one of the many trends that take the fintech world by storm only to vanish a few months later (dash buttons, anyone?).

Far from being a passing fad, the technology is already revolutionizing how financial services are offered and consumed, presenting tailor-made products to customers at the time and on the platform where it makes most sense.

But what is embedded finance exactly? How does it work? Why is it a game-changer?

And why is it that neither the German Wikipedia nor the English Wikipedia offer a dedicated article on such an important topic in the digital finance industry? At least not an article of its own that this exciting topic would deserve.

We have all the answers below.

What is embedded finance?

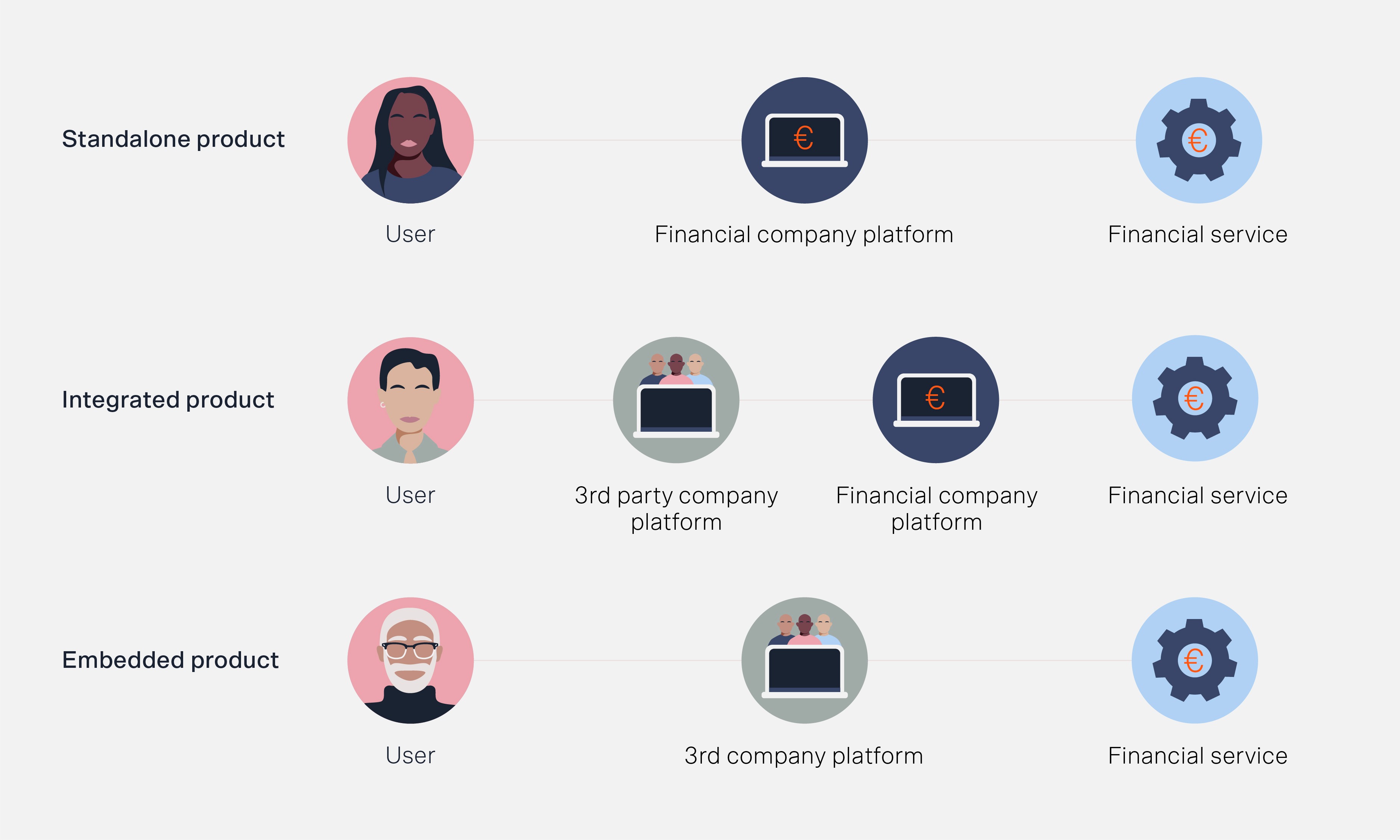

Embedded finance makes it possible for any business to offer financial services to its customers at the point of need.

The product is integrated seamlessly into an existing user journey. For example, you could be offered a buy now pay later loan when you're about to check out from an online store. Or a health insurance policy when you log on to your gym's app to renew your membership.

The customer always deals with the business directly, never with a third party. But, even though the product belongs to the business, the business doesn't need to obtain a financial services license or do any of the other regulatory activities that financial services businesses typically have to do.

A licensed partner, for example with a full banking license, an e-money license or special licenses for trading and custody of cryptocurrencies, takes over this part in the background.

We will come back to this aspect in detail.

How does embedded finance work?

Imagine you wanted to start a take-away food business.

Typically, you'd need to invest significant time and money to set it up, and you'd also have ongoing obligations.

You'd need to lease premises, buy equipment, hire staff, and make sure you comply with health and safety regulations. You'd also have to develop a menu, source ingredients, lease and service your fleet of delivery vehicles, and manage bookings, all while marketing your business.

But there's also another alternative: you could partner with third party-specialists.

An established professional kitchen could give you access to their premises, equipment, highly trained staff, and ingredients, and take care of compliance with health and safety regulations in exchange for a fee. And apps like Wolt and Lieferando could handle customer orders and deliveries.

That would leave you with just the concept, menu, and marketing to worry about.

Put simply, by drawing on somebody else's infrastructure, knowledge, and expertise you could focus on designing a great product instead of having to put together every single aspect of the operation from scratch.

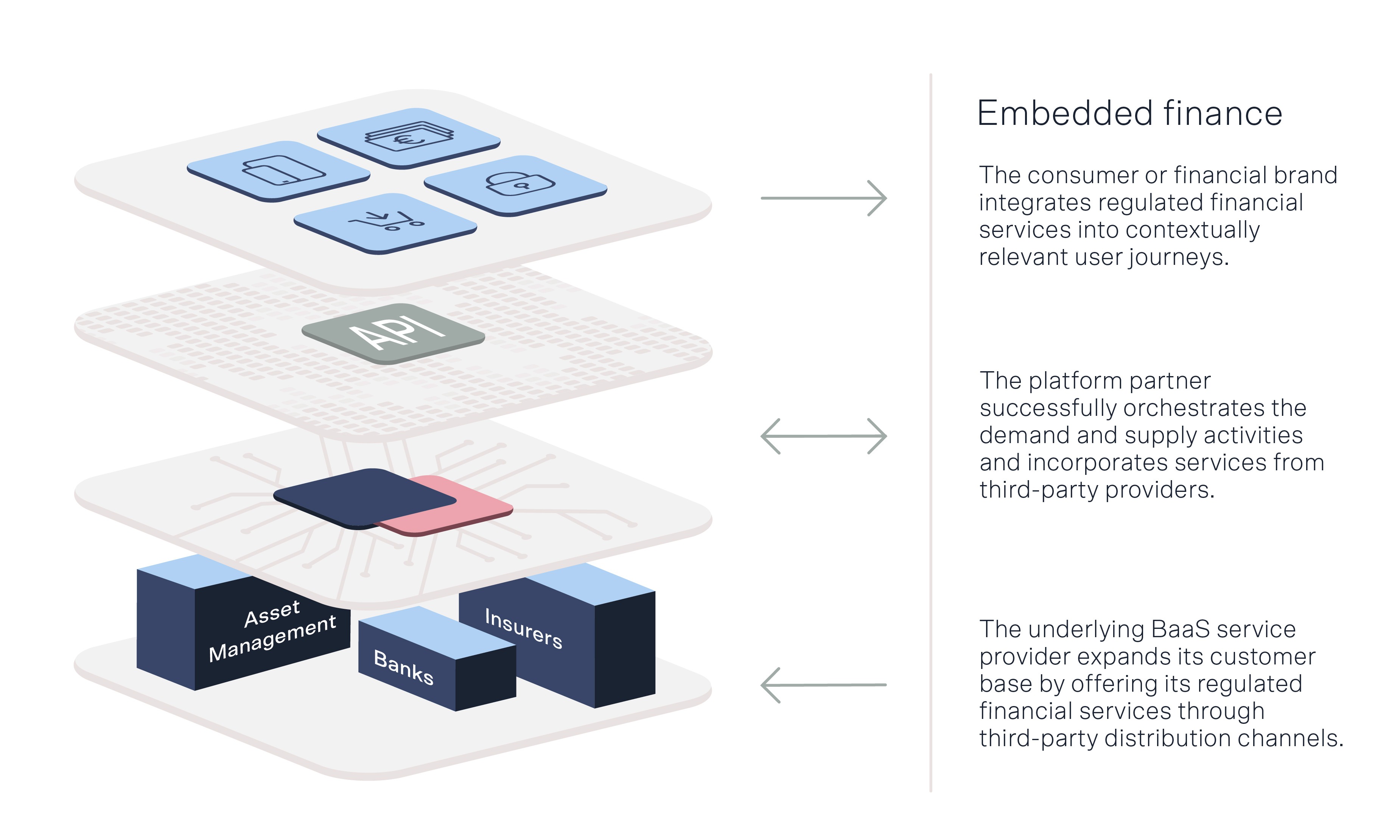

Embedded finance works in a similar way:

-

For example, a banking-as-a-service provider, productizes its financial services license, back-office operations, and know-how, and offers this service to other businesses in the form of an API, or application programming interface – a string of computer code that enables different pieces of software to talk to each other.

-

The API is the delivery mechanism for any embedded finance provider's product. It's useful to think of an API like a restaurant menu. Just as a menu enables you to order the food you want from the kitchen, an API enables a piece of software — your e-commerce app, for example — to get what it needs from the embedded finance provider. APIs follow established design standards, so they're interoperable and integrate easily with other systems and technologies.

-

Any business that wants to offer embedded finance products purchases access to one or more APIs. This business has two options. It can plug into a ready-made API, put their branding on the product, and offer it as if it were their own — what is known as white-labeling. Alternatively, it can use one or several APIs as building blocks to create a unique new product or service which it then offers to its customers or sells to other businesses.

What are the benefits of embedded finance?

If you're a business, embedded finance has three key benefits:

1. Faster go-to-market time

Partnering with a banking-as-a-service or a payment provider saves time and reduces complexity, enabling businesses to launch high quality financial services products quickly and cost effectively.

There's no need for you to go through the long, time-consuming, and expensive process of obtaining a license. Nor do you have to pivot part of your operations towards financial services, buy infrastructure, hire specialist staff like compliance professionals, or go through months of trial and error.

Partnering with Solaris, for instance, made it possible for neobank Tomorrow to go from idea to live in just 6 months. In comparison, it takes around 15 months only to obtain an e-money license and 18 months or more to get a full banking license.

Furthermore, partnering with a banking-as-a-service provider can be advantageous to licensed financial services firms too, because it allows them to call on expertise they might not have in house.

In this way, capacity bottlenecks in product development can be bridged or entire projects can be implemented in the shortest possible time to respond to trends.

Case in point, when American Express — a financial giant that needs no introduction — decided to launch a buy now pay later product, partnering with Solaris meant they didn't have to navigate the regulatory complexities these kinds of consumer lending products entail.

2. Broader appeal

If you're a non-financial business, embedding complementary financial services into an existing user journey can give you a competitive edge by enabling you to offer a more complete and, so, more valuable product.

Adding buy now pay later capabilities through the Splitpay API, for instance, has made it possible for American Express to give customers much more flexibility than their competitors.

Similarly, offering health insurance policies alongside its core services could enable a gym to position itself as a one-stop-shop for all its customers' health and wellness needs.

But embedded finance can increase your appeal and broaden your reach even if you don't offer it to customers directly.

For banks and other traditional financial services firms, partnering with a specialist and productizing their services into an API could enable them to reach a wider audience without increasing customer acquisition costs.

In fact, rather than be out of pocket, they'd generate revenue by selling access to their API.

Banking heavyweight Goldman Sachs did this when it partnered with Apple so the tech giant could create its branded credit card. Similarly, several banks have partnered with Google for an upcoming embedded banking product, code-named Project Cache.

Research suggests it costs non-financial brands like e-commerce retailers up to 30 times less what it costs a traditional financial services firm to acquire a new customer. So selling embedded finance APIs is an opportunity for financial services firms to widen their addressable market by orders of magnitude.

3. Stronger customer relationships

Embedded finance is an opportunity to create stickier relationships with customers by offering them more flexibility and more value while boosting revenue.

Buy now pay later products, for instance, lower cart abandonment and increase basket size, because they enable the customer to make their purchases more affordable by spreading out their payments.

E-commerce providers in particular have benefited greatly from embedded financial solutions in recent years. Frictionless check-out processes through the integration of payment providers have been the measure of all things – but this is just the beginning.

More to the point, embedded finance increases the number of customer touchpoints.

If you offer a credit card, for instance, your brand will be front and center in customers' minds even when they're not buying from you. And if customers interact with your brand more frequently, they'll start trusting you more.

But embedded finance benefits customers too.

Instead of having to carry out independent research, find something that's a reasonably good fit, and jump through several hoops to apply, they're presented with a relevant product — one they might not have even known they needed — at the moment when they need it.

And because many businesses have lots of data about their consumers, they can tailor the product so it's more personalized and better addresses their pain points.

Embedded finance is transforming financial services. Are you in or out?

Amazon. Uber. Wolt.

If you've purchased something from any one of these apps at least once — and, chances are, you have — you've already used embedded finance. And those are just three big examples.

Embedded finance isn't a hypothetical. It's part of daily life, today. And it's changing the industry as we know it, making financial services more user-friendly, more convenient, and more personal.

As the technology continues to mature, it'll become even more commonplace and we'll likely see use cases we might not even have thought of yet. Partnering with the right banking-as-a-service provider can help you make sure you make the most of the opportunity, instead of looking on from the sidelines.