The International Merchant Payment Solution: virtual IBANs for cross-border commerce

3 minute read

Ecommerce has radically reshaped the retail sector in recent years, as online platforms have given international merchants and manufacturers a way to reach customers directly, cutting out the middleman and the need for a local distributor.

Why do you need a virtual IBAN?

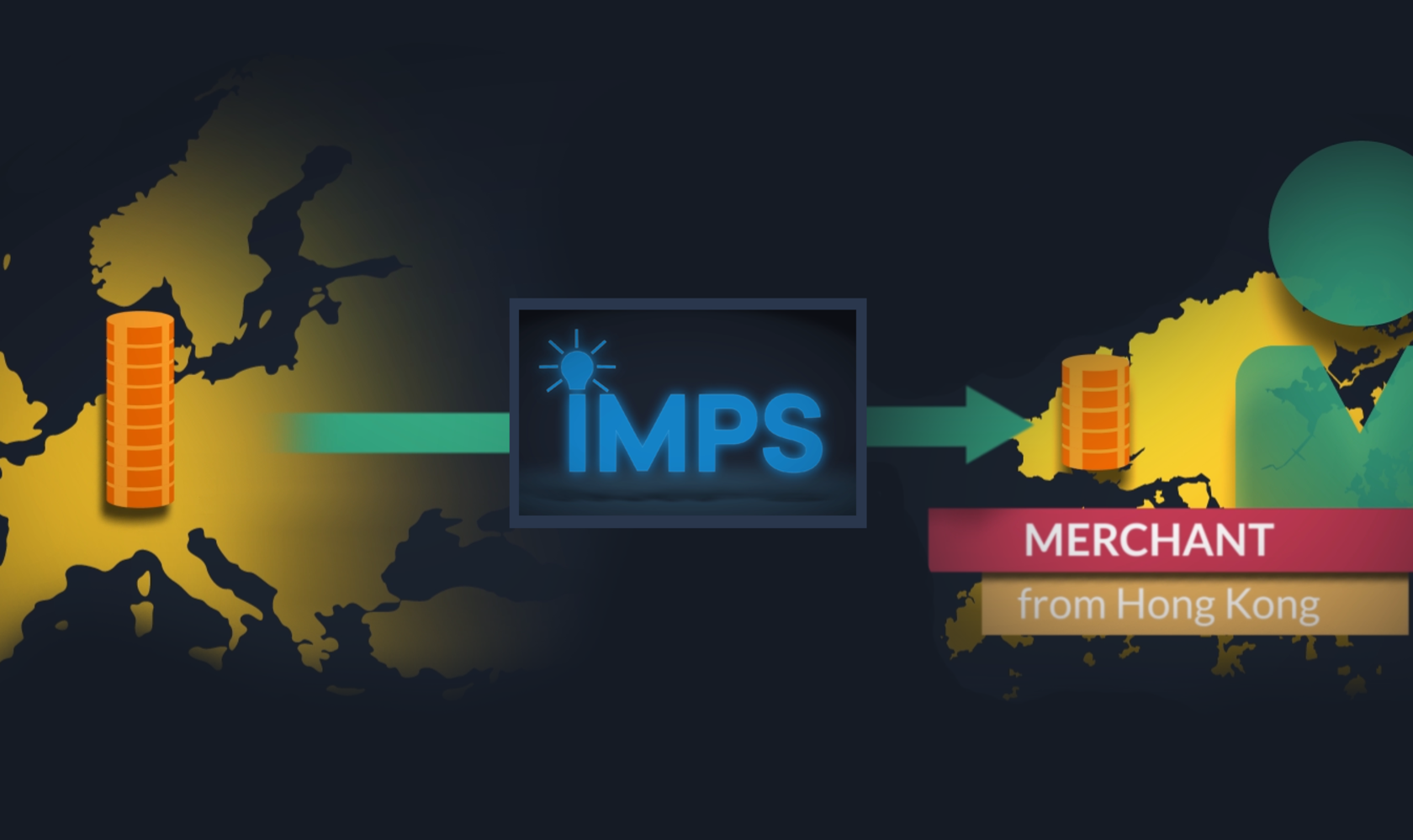

Regulatory barriers and high transaction costs have discouraged many international merchants from selling their goods in the lucrative European market. solarisBank has developed the International Merchant Payment Solution (IMPS), which uses our virtual IBAN technology, to address this challenge. The IMPS offers merchants and manufacturers affordable terms, convenience and regulatory compliance.

Two main factors complicate the process of directly repatriating sales revenue from the EU for foreign merchants. First, ecommerce platforms can charge high fees to pay out directly to international bank accounts, and foreign exchange fees further increase the cost. Second, opening a business bank account in Europe can be a difficult, expensive and lengthy process for foreign businesses due to strong anti-money laundering (AML) and Know Your Customer (KYC) regulations. Both methods are costly, especially for smaller merchants. When merchants initiate transfers on their own, they have no choice but to pay the high fees charged by retail banks and ecommerce platforms.

Our solution: How does IMPS work?

In order to address this problem, a new class of innovative payment facilitators such as Skyee and Vcan have emerged to provide an ingenious, convenient, and lower cost approach. IMPS allows solarisBank to receive funds in Europe on behalf of foreign merchants and forward them to payment facilitators, who are licensed money service operators, for efficient, cost-effective distribution in their home countries. This eliminates the need for individual European merchant bank accounts and can help avoid hefty transaction fees.

Additionally, these payment facilitators can serve merchants in their own language for added convenience — unlike most European banks — and even provide 24/7 customer service if they wish.

Powering IMPS is a technology called the virtual International Bank Account Number, or virtual IBAN for short. IMPS uses a solarisBank collection account connected to a nearly unlimited number of virtual IBANs. Each virtual IBAN is a unique identifier assigned to a specific merchant, transaction, product line, or other variable for tracking purposes. Otherwise, they look and function just like the real IBANs used to send and receive money by millions of companies and individuals every day.

When a merchant sells something online using IMPS, the ecommerce platform transfers the payment to the merchant’s unique vIBAN. The funds are automatically routed to a solarisBank collection account, and the vIBAN unique identifier makes it simple to keep track of which incoming payments belong to each merchant. Payment facilitators can monitor transactions via the solarisBank API or web interface to ensure accurate settlement and clearing. Money is then transferred regularly in large sums from the solarisBank collection account in Europe to the payment facilitator’s home country account.

Bundling payments together is what enables solarisBank to keep transfer and administrative costs so low. Rather than thousands of merchants paying expensive international fees individually, IMPS sends pooled funds overseas at an affordable percentage rate. Soon, solarisBank will also offer fast and economical currency conversions prior to each transfer, so payment facilitators and their merchants can save even more.

The results: case study

Our partner Skyee uses the IMPS to get payments in Europe to Chinese merchants

Since launching this affordable and effective solution in Q4 of 2016, solarisBank has seen monthly payment volumes grow to millions of euros. The benefits are clear: merchants gain access to millions of customers in Europe, save big on transaction costs, and avoid the hassle of setting up and maintaining a bank account in Europe. Whereas traditional financial transfer fees can cut deep into merchant margins, solarisBank offers a sliding percentage-based fee calculated on total transaction volume.

IMPS is currently used by payment facilitators in Asia such as Skyee to allow Asian merchants to access the Eurozone, but solarisBank plans to serve facilitators and merchants in other regions, and eventually extend market access to the UK and USA. The underlying virtual IBAN technology also has the potential to enable transactions in the other direction.