Scaling across Europe: How to simplify international expansion with embedded finance

4 minute read

If you're an ambitious fintech — and, let's face it, nobody puts in all the blood, sweat, and tears required to build a successful startup unless they're the kind of person who dreams big — expanding outside your home market is a key milestone.

But while the single European passport for financial services makes reaching new markets within the EU quicker and easier in some respects, it also has its drawbacks. Plus, you'll still have to contend with local regulatory quirks and consumer preferences.

This is where embedded finance can help.

With the right embedded finance provider by your side, you can expand into the rest of the EU quickly and minimize the cost of doing so, while also avoiding the drawbacks of passporting.

Here's how.

EU passporting: what it is and how it works

First floated in a 1985 EC Commission white paper and implemented during the late 80s and early 90s, the single passport for financial services enables firms licensed in one EU member state to operate in other EU member states.

The idea is that, because all EU regulators set similar standards, they can "mutually recognize" firms licensed in other member states as meeting the minimum criteria to operate in their jurisdiction.

So, if you have a credit institution licence issued by, say BaFIN, the German regulator, you can also offer banking services in France or Italy, without obtaining a local credit institution licence. Instead, you notify the French or Italian regulator of your intention to offer your banking services in their market, and get started.

So far, so straightforward.

The catch is that, when you're passporting, you're technically not a local company. And this can put you at a competitive disadvantage.

The importance of being local

One of passporting's key drawbacks is that IBANs aren't local. If you're a German bank passporting to France, for instance, your French customers' IBANs will be German, not French.

Under EU rules, this shouldn't be a problem. The SEPA regulation stipulates that payers and payees across the EU must accept IBANs issued in any member state.

But in reality, consumers who don't have local IBANs can run into difficulties. In 2022, its first full year of operations, Accept My IBAN, a coalition of fintech companies set up to address this issue, known as IBAN discrimination, received over 2000 complaints from people who were unable to pay rent, bills, or even claim tax rebates or other government benefits.

IBAN discrimination aside, passporting also creates three other challenges for firms.

First, because the consumer's money is technically held abroad, it can create complications from a tax perspective.

Second, card payments aren't covered by IBAN discrimination rules. So, if a consumer's card is issued by a bank that's passporting, the consumer may face higher fees or have payments refused, and there's nothing they (or you) can do about it.

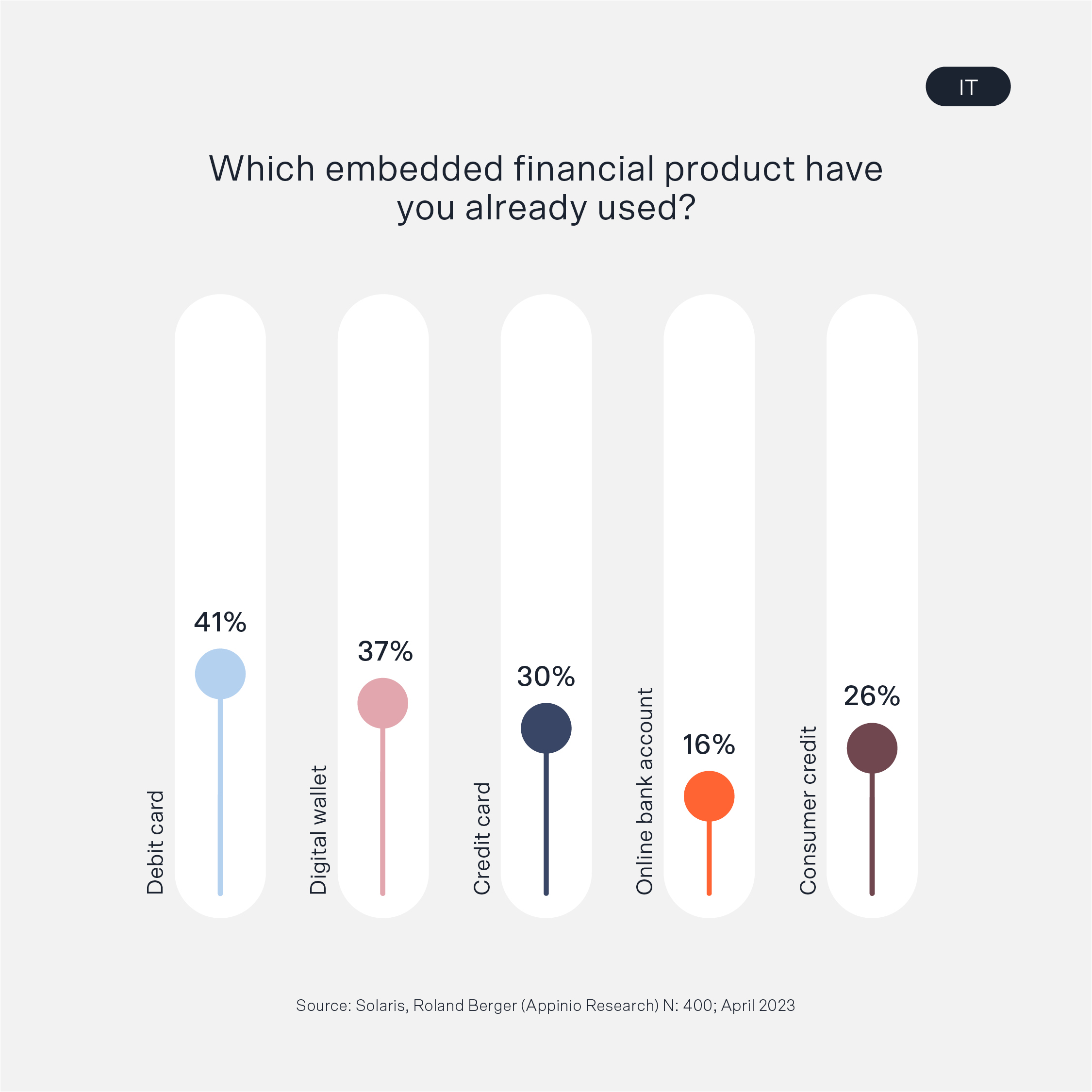

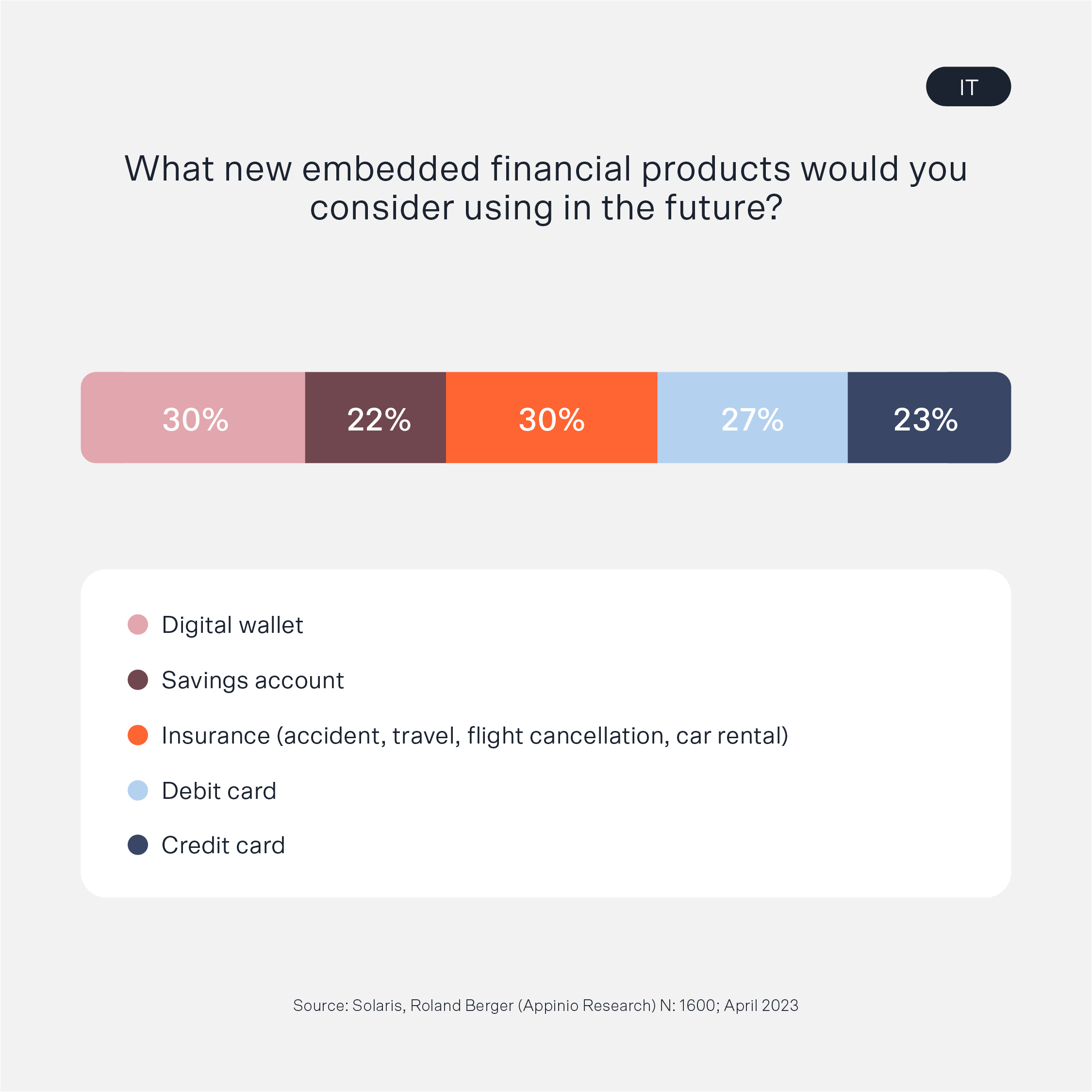

Third, consumer preferences vary dramatically across the EU, and products that work well in your home country may fall flat in another market. Understanding and catering to these local preferences is critical if you want to build trust and drive real growth.

Speaking local, with embedded finance

Clearly, while passporting has significant benefits for firms, its limitations can make it harder to operate outside of your home market and, more importantly, to attract consumers in those markets.

But the traditional alternative — obtaining a local licence in each market you want to expand to — is operationally complex.

The EU's regulatory framework is a mix of "minimum" and "maximum" harmonization. Directives and regulations with a "maximum" approach require member states to implement their rules to the letter. But those with a "minimum" approach only set a baseline, and national regulators are free to add their own spin (as long as they meet minimum requirements).

As a firm, this means transaction limits, reporting, and other technicalities may vary from one country to another, requiring you to invest significant resources in local compliance.

And that's leaving aside the cost of obtaining a local licence and establishing a local physical presence, and the time factor. It can take 12 to 18 months just to obtain a credit institution licence. Time you can't spend improving your products and attracting new customers.

This is where embedded finance can help.

Working with a good embedded finance partner gives you the best of both worlds.

Your partner takes care of licensing, regulatory compliance, and other back-office functions, enabling you to operate like a local bank, without taking on the complexity this entails.

The right embedded finance partner will also have local experts who can help you both with the regulatory issues that are unique to that market, and consumers' preferences and expectations.

And, the better tailored your products are to the local market, the greater the chances of your expansion's success.

Planning an expansion? Solaris can help you hit the ground running

Revolut. Klarna. N26.

All examples of fintechs that have expanded into new markets with great success.

But, for every successful expansion, there are also many that fail or fall short of expectations. And, when this happens, it's usually down to localization issues: challenges navigating regulatory nuances and getting to grips with customer preferences, attitudes, and expectations that may be vastly different to those of customers at home.

Solaris' embedded finance products are designed to set you up for success.

Our retail and business KYC products streamline onboarding, keeping friction to a minimum and boosting conversion rates while being completely configurable so they meet the regulatory requirements in different markets.

Our APIs are also extensively documented, and the cloud-based infrastructure makes it easy to manage operations in multiple countries from one interface.

Crucially, we use a local branching approach. In other words, we apply to local regulators and adapt our German credit institution licence to their requirements.

As a result, when you partner with us, you're able to tailor your products to each market you're expanding to, including by issuing local IBANs and cards. You'll also have access to specialists who are based in that market and, so, have practical local knowledge of what works (and doesn't work) and can support you every step of the way.