Payment Flows: levelling up the insurance industry

6 minute read

What if your finance team knew exactly how much money was coming in and going out of your insurance company, in real time?

A complete, accurate, up to date picture of your inflows and outflows enables you to operate more efficiently.

More importantly, because you can see at a glance whether customers have paid their premiums, you can pay out claims more quickly and avoid mistakes — like rejecting valid claims — that could damage your reputation.

Unfortunately, while, with an average of 1.2 billion transactions daily, Germany is the European leader in real-time payments, those transactions only represent 2.5% of all electronic payment flows.

The vast majority of the country's payments can take several hours to several days to settle. And, in the insurance industry, these delays generate unnecessary admin, increase risk, and drive up costs for everyone — insurers and insured.

Solaris' Payment Flows is designed to prevent these — and other payment-related issues — from happening. Payment data updates automatically, in real time, so you always have a complete and accurate picture of your financial position.

Here's an in-depth look at how Payment Flows works, and four compelling reasons why it's a better option for your insurance business than using traditional payment rails.

What is Payment Flows?

Payment Flows is an API-based money-movement platform.

Insurers can take payments and make payouts in five main ways: SEPA Direct Debit, SEPA Credit Transfer, SEPA Instant, peer-to-peer, and digital wallets. This gives your customers choice and flexibility.

More to the point, Payment Flows processes data instantly, so your financial records are always up to date.

Imagine a customer called your insurance company's claims department to complain about not having received a payout.

Your claims adjuster knows customer satisfaction and loyalty are closely linked to the quality of the claims process. So, to keep them happy, they pay the claim. But when your finance team reconciles your payment data three weeks later, they learn that the client didn't have an active policy. When they bought it, there was a glitch and payment failed. So, technically, they weren't entitled to the payout.

With Payment Flows, the claims adjuster wouldn't have had to wait for the finance team to reconcile the data to find out if they should have paid the claim. They'd have been able to see whether the customer had an active policy straight away.

Webhooks also make it possible to create event-driven workflows. You can set up alerts so you're notified within seconds of receiving customer payments. And you can create a notification system, so customers are informed when you take a payment or they receive a claims payout.

The power of real-time visibility: Payment Flows' 3 key benefits

Payment Flows has two big advantages over traditional payment rails. First, because the platform communicates with payment networks through APIs, it minimizes admin. Your system updates automatically, and there's no need for employees to wade through spreadsheets to manually track and reconcile individual payments.

Second, because your payment data is always up to date, you have complete, real-time visibility into your incomings and outgoings. In other words, when a customer pays their premium, or you pay out a claim, you'll know immediately.

The bottom line is that using Payment Flows:

-

Is more operationally efficient than using traditional payment rails

-

Helps make you a more attractive employer

-

Enables you to provide better customer service

Allocate resources more effectively

The single biggest issue with traditional payment rails is the sheer amount of admin needed to monitor payments and payouts.

In 2022, German insurers processed €148.1 billion in payments just in the non-life sector. 66.4% of the country's electronic payments aren't settled in real time. So around €99 billion of those payments had to be manually tracked and reconciled.

By automating most of the process, Payment Flows frees up staff to focus on work that helps move the business forward, instead of spending hours or days sifting through spreadsheets.

More importantly, having access to real-time data enables you to be proactive.

Where, with traditional payment rails, it's often only possible to spot issues like missed payments after the fact, Payment Flows gives you an accurate understanding of your risk exposure at any given point in time, so you can act swiftly and adapt to changing circumstances.

Attract top talent

Automation in the workplace is often presented as a threat. But research suggests that, in workplaces with high levels of automation, employees are often happier and more engaged.

Because a platform like Payment Flows tracks payments and updates financial data automatically, it saves staff having to wrestle with time-consuming, repetitive tasks, freeing them up to focus on more fulfilling work. And, in a 2022 survey, job satisfaction was the second most important factor after salary when considering switching jobs.

Automation, observe PwC's Julia Lamm and Marie Carr, "is an excellent selling point with [both] existing and prospective employees…"

Current staff will be more likely to stick around. You'll also be more attractive to highly motivated candidates looking to make an impact.

Treat customers fairly

Manual admin isn't just costly, time-consuming, and bad for staff morale. It also creates an enormous amount of risk.

Customers who are no longer insured — or, to refer back to our example, were never insured in the first place — might obtain claims payouts they aren't entitled to.

At the other end of the spectrum, you might refuse a legitimate claim based on outdated or inaccurate data.

The single biggest consequence of these risks is that loyalty is invariably penalized. Insurance policies are priced aggressively to attract new customers, while renewals can be as much as 70% more expensive, even when the customer hasn't claimed.

This serves nobody. Customer acquisition costs and churn are some of the highest in any industry. And, because large numbers of consumers switch every year to get better value, it's hard to build up enough data to deliver a better service.

Having access to real-time data eliminates or reduces many of these risks.

Claims adjusters can instantly see whether a claimant is current on their premiums. Even better, you can adjust customers' premiums based on their latest claims data, instead of having to average it out based on outdated information.

Levelling up: offering insurance customers more value through a wider financial ecosystem

Payment Flows is also part of Solaris' wider ecosystem of APIs. So, alongside fairer pricing, insurers can offer customers more value through complementary financial services products such as bank accounts and payment cards.

Embedded financial services can help insurers stand out and build stronger customer relationships, because they create more opportunities for interaction.

The customer doesn't deal with the insurer only at renewal time or when making a claim. If they have a co-branded payment card, for instance, the insurer is front of mind on a day-to-day basis: when buying groceries, shopping online, getting a take-away coffee, or even sending money to a family member or friend.

They're also a way to give customers more value through rewards and other perks. And with Solaris' issuing model insurers earn part of the interchange fees on every card transaction, creating a new revenue stream.

Most significantly, embedded financial services products give you a much broader data-set to work with — not just the customer's personal history, how much they've paid, and how much they've claimed, but also their broader purchase history.

This data paints a clearer picture of the customer's lifestyle and personal preferences, putting you in a better position to assess risk and offer highly relevant and personalized products at the point of need.

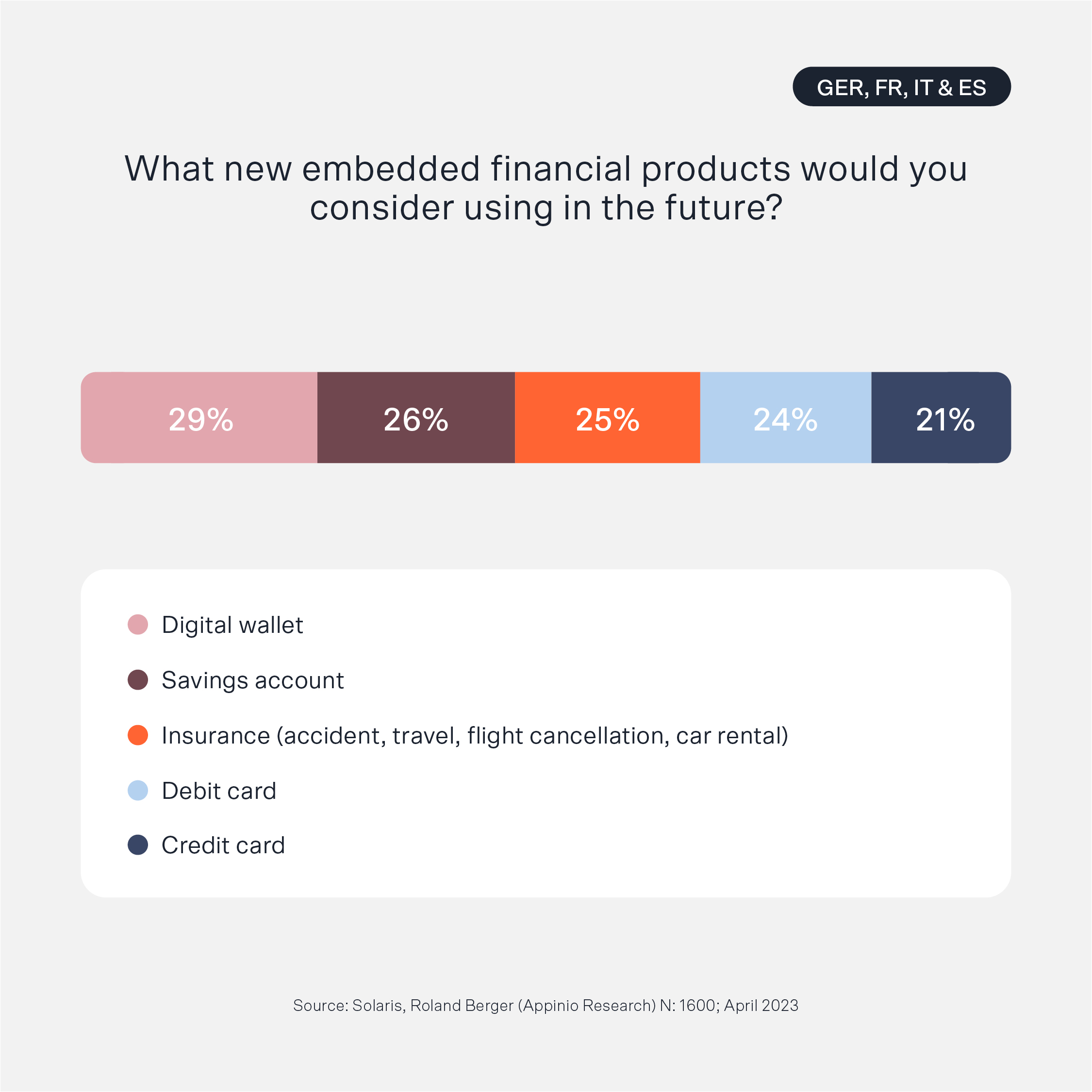

And our own research shows that customers would like to use different types of embedded insurance - so what could be more obvious for an insurer than to make its own insurance products API-ready and include them in its own payment card. A win-win situation for insurers and customers.

Strengthen customer relationships, with better payment infrastructure

Incumbent insurers used to be able to rely on a core base of loyal customers.

With growing competition, the skyrocketing cost of living, and renewals often costing hundreds of Euros more than switching, loyalty is increasingly at a premium. Consumers are rethinking how they insure, moving towards digital-first, on-demand products that give them more flexibility, more control, and greater personalization.

The good news is that German insurance incumbents still enjoy a dominant market position and higher levels of customer satisfaction than any other financial services sector. But unless they overhaul their payments infrastructure, they could fall behind.

Using a product like Solaris' Payment Flows slashes admin, lowers risk, and, most importantly, empowers you to improve your offering in ways that meet — and exceed — customers' expectations.