Money management firms must get on board with embedded finance. Here's why!

8 minute read

The traditional money management business model, built on long-standing relationships legacy firms have built through face-to-face interactions, rather than cutting-edge technology, is no longer fit for purpose.

With relatively simple eligibility requirements, low fees, and a digital-first approach, robo-advisers, neobrokers, and, to a lesser extent, crypto-trading platforms, have attracted younger, digitally-savvy consumers whose financial circumstances and goals are a far cry from those of the typical wealth management consumer — ultra-rich, older, and predominantly male.

But change is coming even to the high-net-worth segment.

Over the next 20 years, $84 trillion in wealth will switch hands, with $72 trillion of it going to Millennials and Gen Z. And 87% of them will fire their financial advisors in favor of firms that have the digital capabilities they expect. That is, firms that are at least as good at digital as tech giants like Apple, Google, and Amazon.

For legacy money management firms the message is clear: up your game, get on with the times, or risk being left behind. And, according to our latest white paper — Opportunity knocks for embedded finance in the wealth industry — embedded finance holds the key to meeting this new breed of customer where they are and future-proofing your business.

So, how can embedded finance help money management firms digitalize and stay relevant as the market evolves? And, more to the point, when (and how) should they get started with embedded finance?

Why moving from analog to digital is the missing link in how money management firms do personalization

That the client experience is already a top priority for an overwhelming majority of wealth management firms shouldn't be surprising.

While personalization is valued in every financial services vertical, it's especially critical in the wealth management space, where consumers entrust advisors with their hard-earned savings or assets they've accumulated over generations.

This is particularly true among younger consumers, with 51% of respondents aged 35 to 54 telling Refinitiv they were willing to pay more for products and services that are tailor-made to their unique requirements.

The upshot is that the money management firms that are most attuned to their customers' financial circumstances and needs stand to gain a significant competitive advantage. Embedded finance products can provide a wealth of data they can use to enhance personalization to the point where they could even anticipate individual consumers' needs, and to do so via digital means, which is the main way most consumers now prefer to interact with money management firms.

Co-branded debit and credit cards are especially effective, for two reasons.

First, unlike, say, loans or investments, cards are a relatively low-stakes product. Debit or pre-paid cards in particular carry minimal risk, because the consumer can only spend what's in their account, and they're usually free, so they're an easy entry point. The average German, for instance, owns three cards.

Second, our research suggests most consumers who own a card issued by a wealth management firm use it as their primary payment card. This in-depth, real-time view of individuals' outgoings and spending patterns are a source of invaluable insights firms can use to enhance their existing offering or create new products.

Say a high-net-worth client spends significant sums of money on travel. Armed with this data, a money management firm could:

-

Create travel-focused financial products, such as funds that invest in luxury hotels or resorts

-

Launch a concierge service that enables customers to earn exclusive perks and rewards when they use the branded card to pay for travel-related products or services from the firm's partners

-

Create a travel insurance product, better incorporate travel into their financial planning service, or even improve fraud detection so there are fewer false positives

At the other end of the spectrum, firms could use data on consumers with student loans or other debt to create products that help them budget more effectively and make their money stretch further.

Outsmarting the competition

While digital-first, data-driven personalization is one of embedded finance's most compelling benefits, it's by no means the only one. Embedded finance products also boost loyalty, increase stickiness, and broaden firms' reach. All while creating valuable new revenue streams.

"Money management firms can use embedded finance products to create a seamless ecosystem," explains Solaris' head of European sales Joerg Abrolat.

"When a consumer has a branded card, a bank account, or a loan, they're more likely to be loyal to the firm and stick around, because the firm is now part of their everyday life. There are also a greater number of touchpoints than in the typical investor-adviser relationship. The customer interacts with the brand whenever they check their bank balance, go to the supermarket, or get dinner with family and friends."

The increased number of touchpoints boosts loyalty by creating a virtuous cycle. The more often the consumer interacts with the brand, the more familiar with it they become. And the more familiar a brand is to the customer, the more likely it is that that customer will trust it.

The right product at the right time

An underrated benefit of embedded finance is that, because it's integrated into an existing user journey, firms can suggest a relevant product to the customer at the moment when they need it most.

The customer doesn't have to put effort into researching different solutions to their problem. In fact, they might not even realize they have a problem. Instead, they're presented with a tailor-made product that addresses a specific pain point, at the moment when they're most likely to be feeling that pain.

There are various scenarios in which money management firms could leverage this characteristic to their advantage. Here are just three examples:

-

Partnering with workplace apps to offer personalized retirement planning or investment services based on individuals' salaries

-

Offering round-up savings or fractional investing at the checkout, on consumers' favorite ecommerce platforms

-

Real-time wealth management advice based on data gathered from the consumer's various accounts or their favorite budgeting app using open banking

Using embedded finance in this way dramatically boosts conversions and lowers acquisition costs. For instance, McKinsey estimates that acquiring an SME lending lead through embedded finance is up to twenty times cheaper than acquiring them via traditional channels.

The revenue opportunity

While you'd think issuing branded cards would encourage consumers to withdraw their investments, our research found the opposite may actually be true.

According to data we gathered on a branded card program, financial services was the third most popular spending category after groceries and eating out, suggesting branded credit cards encourage consumers to reinvest their money or invest more.

But the revenue opportunities for money management firms go beyond increasing the volume of assets under management.

Solaris' model, for instance, means firms who offer branded credit cards earn part of the interchange fee on every transaction.

Firms can also earn interest on loans or monetize products by giving customers the option of paying for premium features such as higher transaction limits, more cashback, or bigger rewards.

Getting started with embedded finance: What money management firms need to know

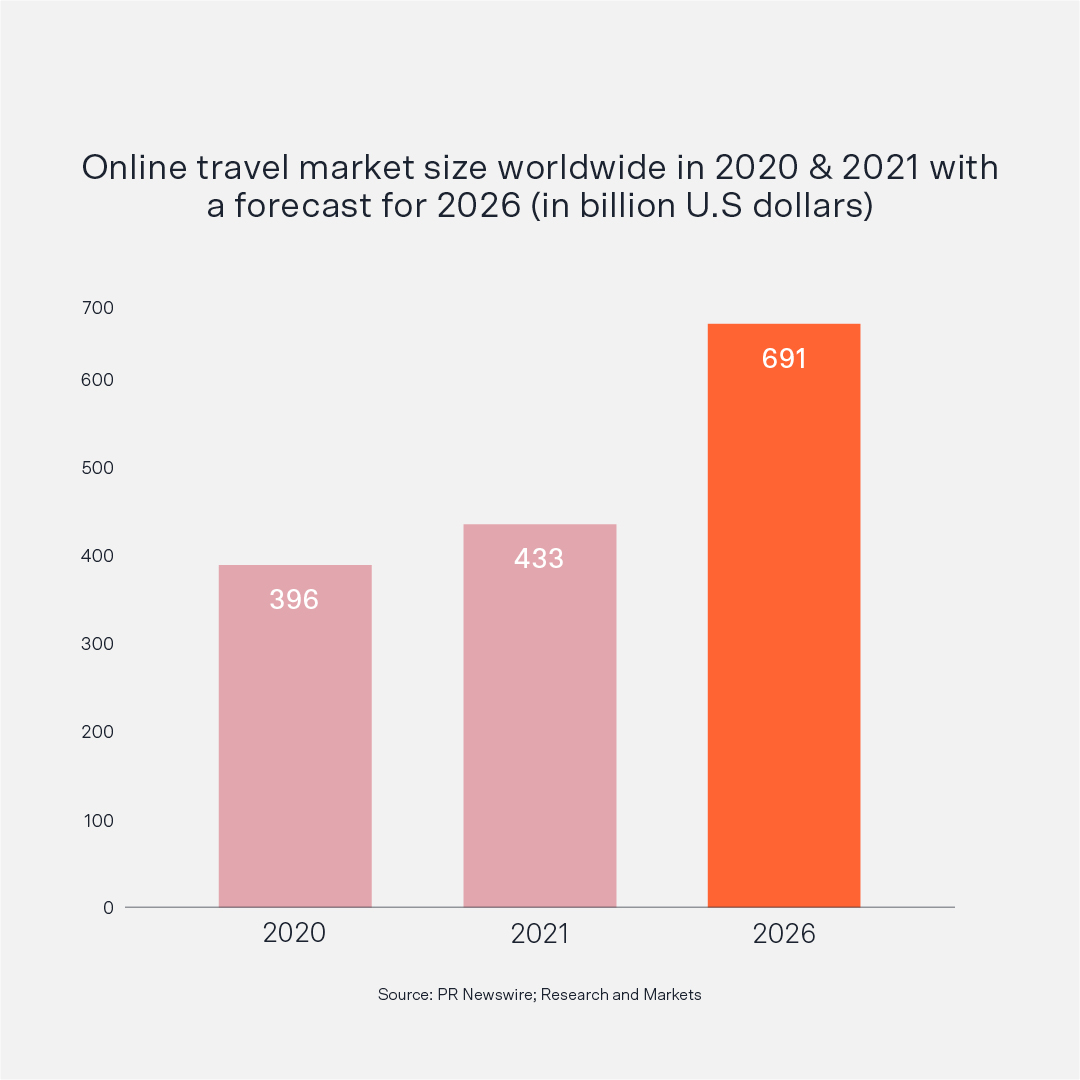

Given the benefits (and the increasingly competitive landscape — neobrokers, money management firms' key competitors, are expected to hit $1.7 trillion in revenue by 2028), the sooner money managers get started with embedded finance, the better.

"The shift is accelerating, so delays come with an opportunity cost," says Joerg Abrolat. "The longer firms take to start, the more likely it is that other firms will have already gone in and gained the first-mover advantage."

But how do you get started with embedded finance?

Step 1: Market research

"First things first," says Joerg Abrolat, "it's worth studying what your competitors are doing. Which embedded finance products do they offer? And what's their overall strategy?"

One of the biggest strengths of the embedded finance model is that it enables firms to expand into new markets by leveraging their current customer base and brand.

The idea is that, if a customer already has a relationship with the firm and is reasonably satisfied with the service, it's not a big leap for them to purchase another financial services product from that firm. Especially if that product is highly targeted and presented at the point of need.

That said, while competitor research can help inspire an initial strategy, it's also worth looking for market gaps that can be exploited through partnerships with other brands, including non-financial ones.

These partnerships can put money management firms in front of consumers who might not have considered wealth management otherwise.

Step 2: Assess readiness

What does your current infrastructure look like? What expertise, resources, and capabilities do you have in-house? And what would you need to outsource?

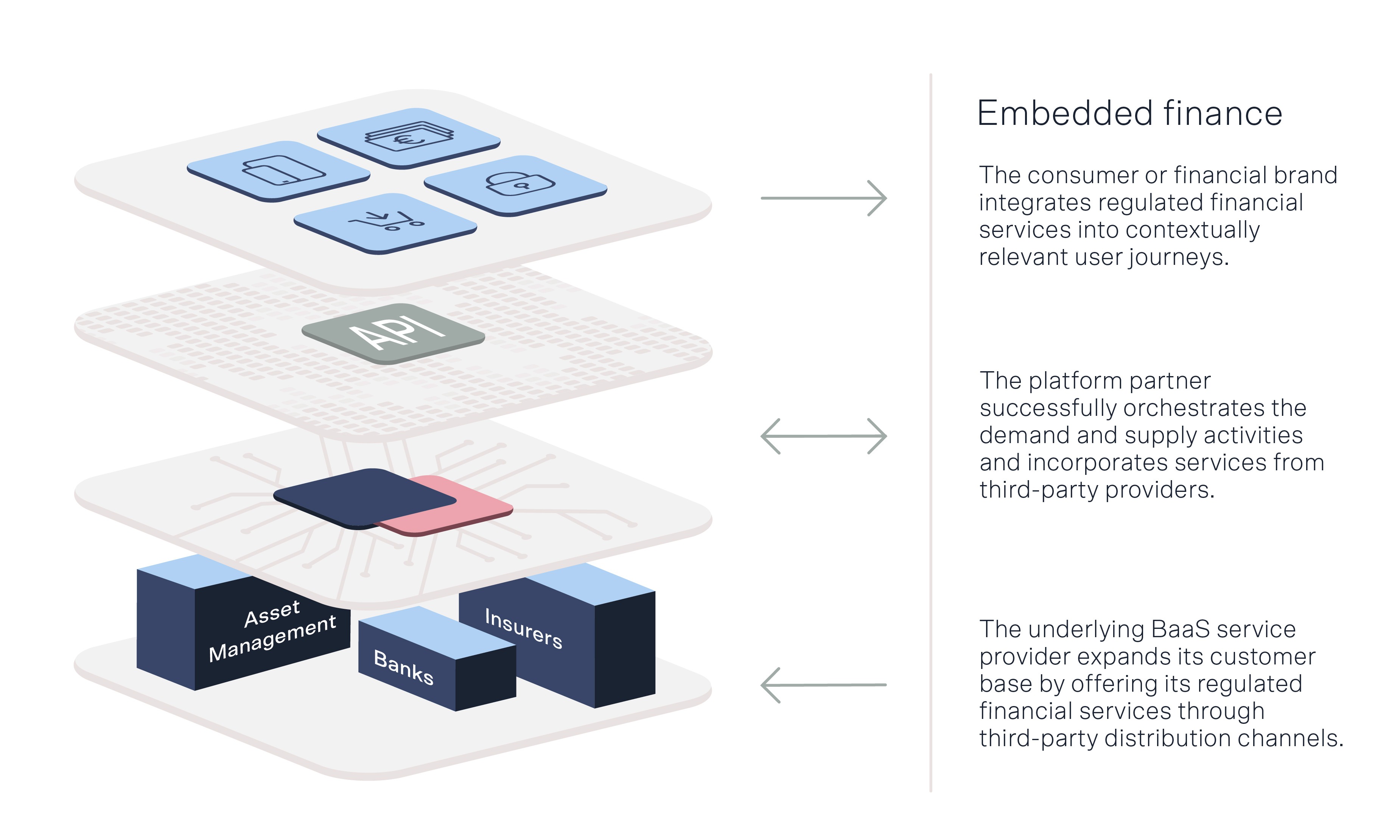

"The benefit of working with a specialist embedded finance provider," says Joerg Abrolat, "is that they can step in where firms have gaps. For instance, as regulated financial services firms, money managers already have robust onboarding and KYC processes in place. But, to offer products like cards, accounts, and loans, they'd need a license and, crucially, specialist infrastructure. Because their core business is financial services, not tech, most firms won't have in-house developers with the experience and expertise required to build that infrastructure.”

"An embedded finance provider can handle those things so that the firm won't need to pivot part of its operations, hire specialized staff at significant cost, or go through the lengthy process of applying for a license."

But the right embedded finance provider can also help streamline and enhance processes that are already in place. Firms could make the onboarding process faster and smoother with embedded KYC, for instance.

Step 3: Choose the right partner

When it comes to choosing an embedded finance provider to partner with, there are three key things to consider.

First, what kind of licenses does the embedded finance provider have? And which territories do they cover?

Embedded finance providers typically have either a full banking license or an e-money license. The type of license will impact which embedded finance products you can offer.

Solaris has a full banking license that enables the company to offer prepaid, debit and credit cards, bank accounts and consumer loans.

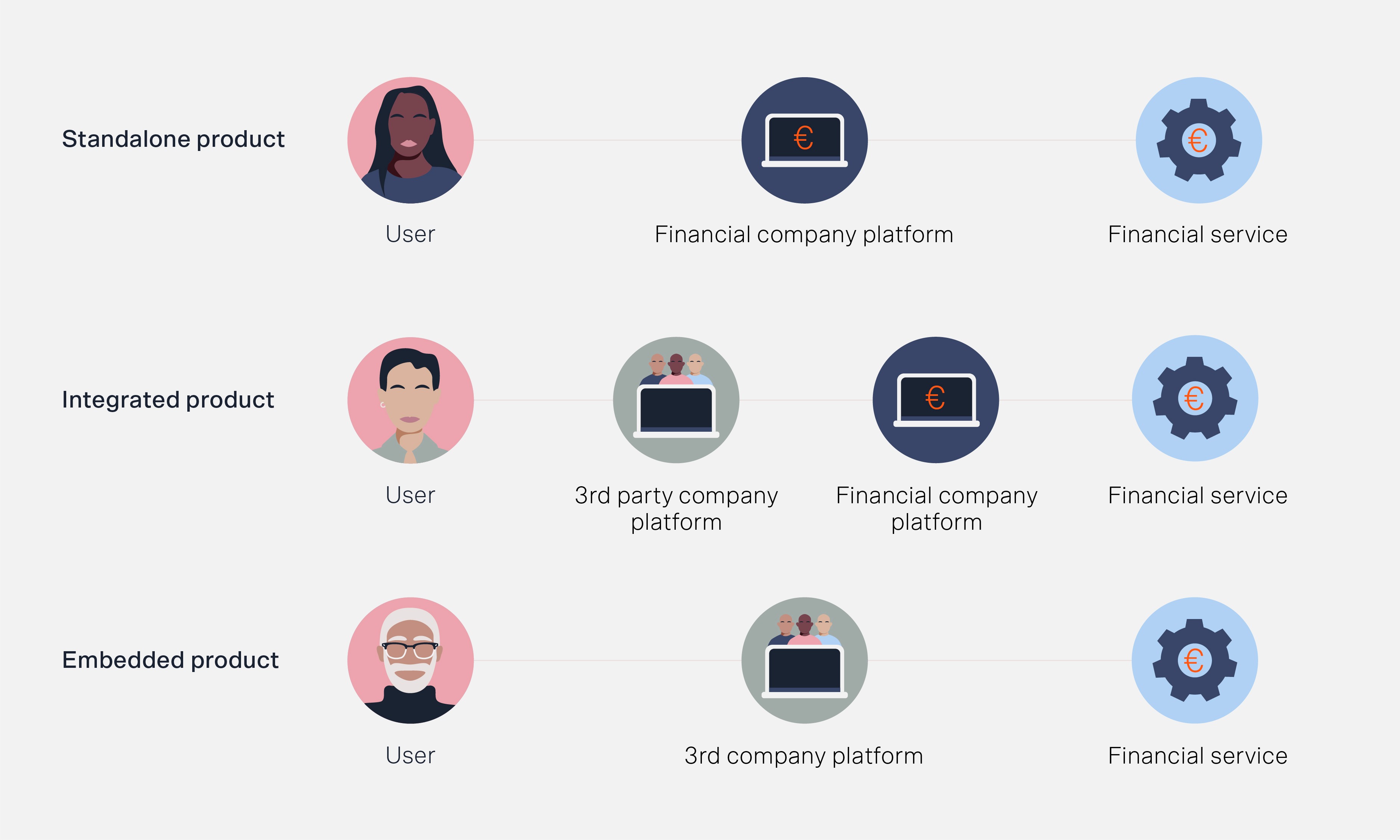

Second, are they white-label solutions or API-based providers?

While white-label solutions enable faster deployment, customization options are typically limited. By contrast, APIs give you far more flexibility when designing your product's front end and features.

Third, do they specialize in a particular area of embedded finance, or offer an end-to-end service?

Specialists have in-depth expertise, but you may need to involve other partners if the scope changes. An end-to-end provider, on the other hand, may lack niche capabilities, but their broader offering gives you the flexibility to change your mind.

Say you go into the process planning to become a BIN sponsor but subsequently decide it's not worth the time and cost. An end-to-end embedded finance provider can step in and act as BIN sponsor instead.

"Solaris' end-to-end model gives you the best of both worlds. Our APIs are comprehensively-documented, making it possible to build and deploy embedded finance products in house. We also have strategic partnerships, for instance with AAZZUR. So, alongside compliance and back-office support, we can also help you plan, design, and build the front-end," concludes Joerg Abrolat.

Ready or not, wealth management is evolving

"There are no two ways about it," says Joerg Abrolat. "change — in consumer demographics, what consumers want from wealth management services, and how consumers prefer to interact with money management firms — is inevitable."

The bad news is that firms will have to rethink their approach in order to succeed in this new landscape.

The good news is that embracing embedded finance can help them stay relevant and boost loyalty.

By enhancing the client experience through hyper-targeted, user-friendly, digital-first products that are presented to the customer at just the right time, legacy money management firms can position themselves as a trusted partner who can anticipate the customer's needs, and create valuable new revenue streams in the bargain.