Interview: how Trade Republic is revolutionizing stock trading

8 minute read

Interview: how Trade Republic is revolutionizing stock trading

As one of the hottest fintechs on the scene right now, Trade Republic has reliably been making the headlines lately. Just months after it’s public launch in May, Trade Republic has announced its Series-A investment — a juicy 10 million Euro round led by prolific venture capital fund Creandum. We sat down with one of Trade Republic’s founders, Christian Hecker, to hear first-hand what Trade Republic is up to currently, and where they are headed in the future. We talked about banking partnerships, digital assets and his love for Borussia Dortmund. We hope you enjoy it as much as we did!

Thanks a lot for having us Christian! For those who haven’t heard of Trade Republic yet, can you briefly explain what you actually offer?

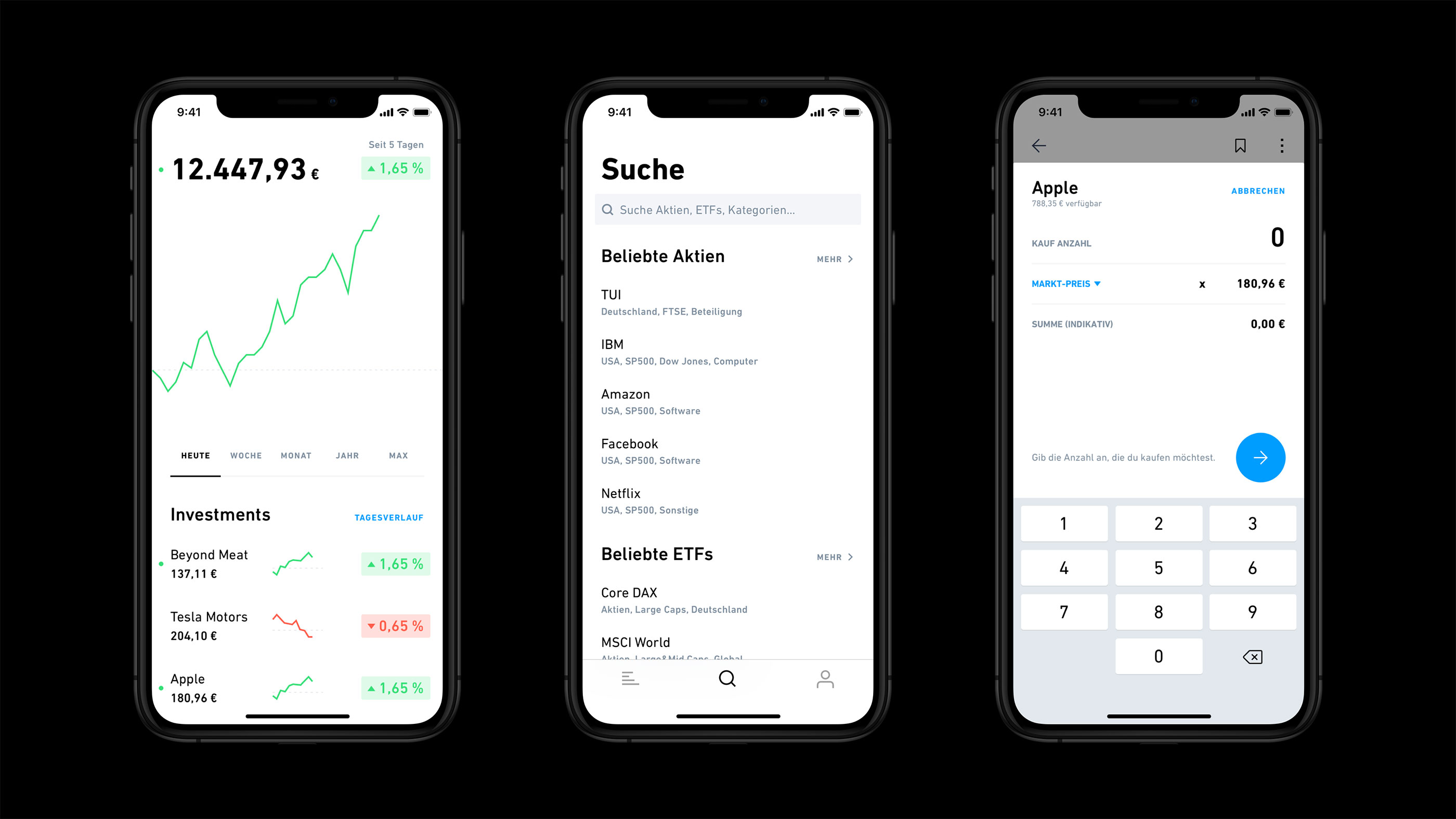

Trade Republic is Europe’s first mobile and commission-free broker. We offer private investors to trade stocks, ETFs and derivatives on a mobile device, entirely commission-free. Trade Republic wants to be the easiest, fastest and cheapest tool to invest in capital markets.

How many assets are tradeable on the app? Is it only European assets or can I also trade international assets?

We’re offering more than 6.8 thousand stocks covering Germany, Europe, the United States and Asia. You can trade Apple, you can trade BMW or you can trade Barrick Gold, which is a gold mine. In addition, we offer over 500 ETFs, covering indices, equities, commodities and currencies as well as over forty thousand derivatives, most of which are knock-out certificates or warrants.

Let’s do a little rewind. How did the idea to start a mobile commission-free brokerage app come about? Was that the original plan? Was that how you started out?

Before we started Trade Republic in 2015, I was working in investment banking. I left my firm just during the time when N26 and Revolut started. For us it was very clear that what they are doing in banking for the current account, somebody’s going to do for the investment account likewise. In other words: make it fresh, beautiful-looking, mobile and ideally with a price advantage. So, we looked into this space and then started to build the product. Then, after a couple of months, we learned that in the United States a company called Robinhood was doing pretty much the same thing. Obviously, that was a great inspiration for us. Seeing their trajectory and the way that they changed brokerage in the States was exactly what was going to happen in Europe sooner or later. So we took the chance and have been working on it for the last three and a half years.

At what point in that journey did you come across solarisBank, and how did the partnership then come about?

Well, if you want to offer commission-free trading, it’s all about margins. Nowadays, under Basel 3 and all the compliance standards, handling customer’s money is very expensive. Thus, the required licensing and compliance costs involved in handling customer funds would be a showstopper for realizing Trade Republic. This is how we found solarisBank as a partner. With solarisBank’s API-accessible escrow account, we can handle our customers funds securely and digitally. The strength of solarisBank’s banking API, a scalable, top notch product for a very low fee, in combination with our expertise in bringing a kick-ass brokerage product to the market, was the perfect combination. This set up is in fact a regulatory innovation — it hasn’t been done before in the brokerage scene. Thus, we needed to touch base with the BaFin and Bundesbank along the entire way. Last Christmas we finally received our banking license as a broker. The result is a very cool partnership I think, because unlike many other partnerships at solarisBank, Trade Republic is a bank itself. We just focus on the stock trading service and all the adjacent businesses, while on the cash side we rely entirely on solarisBank’s capabilities to serve our customers effectively and cost efficiently.

solarisBank is not the only partnership you have. You’ve also mentioned your partnership with HSBC before. Can you tell us a bit about the criteria that you look for when you make a partnership?

First of all, when we started out in 2015, fintech was, at least in my understanding, really on a crusade to get rid of all the banks. That’s what it was all about back then. But we had a different opinion towards that. We think that coexistence of both fintechs and established banks can work. We at Trade Republic don’t want to reinvent the wheel. We want to rely on existing capabilities. Given that, when it comes to choosing partners, I think it’s two things: firstly, it’s how innovative and fast moving they are. As a startup, we are only going to succeed when we’re able to react on customer feedback on a short notice. That’s why I think having solarisBank as a partner is a big plus, because, like ourselves, they have a digital mindset and are able to help us transform customer needs into a real product very quickly. Secondly, it’s about cost efficiency. As a commission-free broker, we need to be more cost effective than the established competition. Our partnerships thus need to fulfil the condition of maximal cost-effectiveness.

Looking ahead a little bit now — can we expect anything in terms of partnerships in the future? For example, are you planning on offering your technology to other banks as well?

The main goal of Trade Republic is to become the number one retail broker in Germany for the mass market investment space. Given that mission, we are currently not planning to offer our service for B2B partnerships. We’re not going to white-label Trade Republic. Trade Republic is going to establish itself as an own brand. But obviously there is a new fintech ecosystem arising where fintechs can collaborate and co-exist together and benefit from each other; especially in Berlin! I think Trade Republic will find its way in this ecosystem to become the trading engine within this fintech playing field. There are always interesting co-operations to look out for to bring new people into trading and brokerage.

Germans are stereotypically wary of investing in stocks. We have a low interest rate era, yet the percentage of Germans that own stocks is much lower than in other developed countries. Why do you think that is? And do you think that the digitization of stock trading is going to change that?

First of all, when we started Trade Republic, we relied on this stereotype as well. If you look closer into the numbers, however, it’s not entirely true. I give it to you that there’s a difference in the investment culture between Europe, the US and UK. But within Europe, the typical German invests exactly the same percentage as the typical French or Spanish citizen.

When it comes to Germany, we believe two things: Firstly, the macroeconomics are very favorable for more and more people to invest. We have demographic changes and a “laissez-faire” monetary policy with interest rates far below the inflation rate. Thus, we believe that in the next ten to fifteen years, for the young generation, so generation y and z, personal investment in capital markets is going to be the only solution to develop a private fortune.

Secondly, and I think that’s what Trade Republic is bringing into the market with digital and foremost mobile services, we see that a lot of people can really be enabled. Brokerage right now in Germany for example is a very elite product. It involves a lot of numbers and at the biggest brokers in Germany, it often takes you twelve clicks to trade one stock. Trade Republic transformed this by breaking up the process and bringing it onto a mobile device, where you can trade a stock in only three taps. Additionally, we offer people an easy way in. You can now open an account at Trade Republic in less than 10 minutes. A beautiful experience I find, especially compared to the big brokers where you have to send dozens of letters back and forth and wait five to 10 days for your account to be opened.

You talk about generation y and z. Do you already see a difference in the demographics of people who use Trade Republic compared to traditional German brokers?

Surprisingly, we don’t. Trade Republic seems to be a generation wide broker. We see the 18-year-old student and the 60-year-old judge both using Trade Republic actively. We also see it being used across all economic situations. Obviously, the very first users were a little bit younger than the lately joining customers, but it seems to be that mobile services have really penetrated the mass market. I see it in my personal environment — my mother is 65 years old and she uses WhatsApp every day. It’s become a common place for people to interact with their daily services on a mobile device. I mean there are literally no other markets where time is as literally money as in capital markets. Thus, a mobile product is super meaningful and sensible irrespective of your age group.

Looking into the future a little bit — do you plan to offer a Trade Republic outside of Germany as well? If so, what are the challenges behind internationalizing Trade Republic?

Trade Republic is a European project. We’re going to roll out Trade Republic across Europe over the next 24 months. I believe free trading shouldn’t only be available in Germany. The beauty of our digital and regulatory setup with solarisBank and HSBC, is that we’re free to scale across various countries here in Europe. The only real hurdle is adapting to domestic consumer protection law, which can vary slightly between different European countries.

Staying in the future — can you tell us a little bit about your vision of the future of stock trading, and what role you think digital assets will play in that future?

We strongly believe that in five years’ time, trading is going to be a totally different experience from today. If you look at the products currently on the market, you have 12 different exchanges and three to four different currencies you need in order to trade your stocks. This is a historically grown complexity which might have made sense 10–15 years ago. Nowadays, it is entirely sufficient to trade on one exchange in one currency, and thus we believe that the entire current set-up is going to vanish.

By adapting to the new way in which economics and exchanges work, and avoiding all the risks involved in trading on multiple exchanges in multiple currencies, trading is going to be as easy as buying shoes at Amazon. And thanks to the technical revolutions in the trading industry, banks and brokers can offer services for a fraction of the cost, meaning trading is not only going to be easy, but also for free.

Regarding digital assets — it’s hard to say, even after spending years in the industry. We currently don’t see the direct benefit trading stocks as digital assets. But of course, the cryptocurrency market and the products in this ecosystem have really fired up the interest of people to get engaged with investing. Therefore, in general, I think it’s a great trend and we hope that we’ll bring those assets into Trade Republic as well.

Thanks a lot for your insights Christian! To finish off, we have one more fun question. I assume you invest in the stocks yourself — are there any trades that you regret either having done or not having done?

Well, I’m from the Ruhrpott area, so naturally I’m a very big Dortmund fan. That was the first stock I traded personally before Trade Republic. And once we started Trade Republic it was also the very first trade done. I mean, this was back in January before Dortmund got knocked out of the champion’s league, so that was maybe not the best trade economically speaking (laughs). But it was still the greatest trade to do as the first on our own system. And yes, obviously in trading you always have the hindsight bias, right? In reverse order it alwys looks straightforward and crystal clear that a stock would go up. So, I think there are a lot of missed opportunities along the way. But then again, Trade Republic is really the first thing in the morning I check. And I really see that my engagement with capital markets and stock markets is getting deeper and better with the product. And so, I feel that the opportunities being missed has really reduced by a by tenfold in the last six months.

Want to find out more about solarisBank and how we are enabling the future of financial services? Have a look at our website: https://www.solarisbank.com/en/