How to reach the top of the digital wallet

5 minute read

1997 is a year that is not remembered for its technological innovations. The movie Jurassic Park hit the theaters and the English girl group Spice Girls were at the height of their careers.

Quite unnoticed, working WiFi became a reality and the world got its first camera phone. Who would have thought that 25 years later nothing would work without these two inventions - at least almost nothing.

Far away from the major innovation centers, such as the Silicon Valley, in the far north of Europe, another technical revolution was taking place.

Coca Cola launched a few vending machines in Helsinki that let customers purchase a can via text messages. Dial-a-Coke made digital payments possible for the first time.

What does this have to do with today's digital wallet, which is available on all smartphones?

This innovative use case is considered the first example of a digital wallet and introduced the idea of using mobile devices for transactions.

What is a digital wallet

A digital wallet is an online payment application that functions as an electronic version of a physical wallet.

Also called an electronic wallet, e-wallet, or mobile wallet, it enables users to safely store digital versions of payment cards, vouchers, cryptocurrencies, boarding passes, event tickets, and use them for contactless payments or easy checkout with their smartphones or smartwatches.

Digital wallets combine a variety of technologies, including mobile apps, near field communication (NFC), and security mechanisms such as tokenization, to create a user-friendly, mobile, and secure payment experience.

How digital wallets are changing payments

Since the Covid-19 pandemic, consumer payment habits have changed immensely.

According to a study published by Paysafe in 2021, digital wallets are emerging as the most popular alternative payment method, with 43% of respondents using them globally in 2020. Already, digital wallets surpassed cash for in-store payments on a global level in 2021.

And if we look at the latest figures from Germany, the leap in payment behavior towards contactless payments enabled by digital wallets is nothing short of dramatic.

By 2022, 91% of Germans are already using contactless payments. And one in five people in Germany pay with their smartphone or a wearable.

Therefore, it is paramount that providers muscle themselves to the top of the wallet if they intend to benefit from this trend and become their customers’ card of choice for mobile payments.

With Samsung Pay, Google Pay and Apple Pay, three tech heavyweights have gained a strong position in the European digital wallet space – and they are here to stay. With their existing hard- and software empires, they have the direct interface to the consumer, not to mention a significant head start.

Of course, this dominance of the tech giants is no coincidence, considering that Google released the first real digital wallet on the Samsung Nexus S in 2011. Good old times!

But, that does not mean that there isn’t still plenty of space for competition within a wallet. After all, you can have any number of virtual payment cards digitally stored in your wallet – and it’s becoming increasingly valuable for providers to be on top of that virtual pile of cards.

Why is a digital wallet a must-have tool

Businesses that offer their customers a digital wallet benefit in multiple ways.

Not only can the digital wallet be fully tailored to the target group, but it can also be extended continuously as an embedded financial service using customer data.

Here are our top three benefits:

-

Convenience and speed: Offering a digital wallet provides customers with a comfortable and fast way to make payments. Customers no longer need to carry cash or credit cards. With a digital wallet they can make purchases online or in-store with just a few clicks. This makes the payment process more efficient for both the customer and the company.

-

Improved customer experience: A digital wallet can improve the overall customer experience. By offering a secure and convenient payment method, businesses can build trust with their customers - the most important value when it comes to financial services - and create a seamless buying experience. This can lead to higher customer satisfaction and loyalty.

-

Cost cutting: Digital wallets can also save businesses money by reducing costs associated with traditional payment methods. Digital transactions are typically less expensive and can help businesses save on processing fees.

Of course, a company only gets to the top of the digital wallet if it offers its own payment card - nothing is easier than that in the digital age.

In a new survey on consumer usage patterns of embedded financial services in April 2023, we were able to show for the four largest European markets - Germany, France, Italy and Spain - that 36% of respondents use digital wallets all the time and another 29% plan to use them in the future.

A promising future for all companies that can put a virtual payment card in their customers' digital wallets.

Why should a brand offer a payment card in the first place?

Any business can now offer physical and virtual cards in their own branding at low cost.

For both banks and non-banks, a payment card can be an effective way to create and maintain a lasting connection between the customer and the brand.

The customer carries the card with them at all times and interacts with the brand every time they make a payment. The more unique and tailored the branding and functionality of the card, the better it can serve as a lifestyle item.

Especially so-called “decoupled cards” that can be linked to the customer’s existing bank account are an attractive option, as it avoids forcing the user to open multiple bank accounts.

What's more? Payment cards are the ideal tool for customer loyalty programs. Gone are the days of paper loyalty cards that always seem to get lost before the final stamp. By linking loyalty rewards directly to a payment card, users can use them immediately and with a much wider range of use cases.

Embedded finance providers like Solaris make this possible by taking over the payment processing and the associated regulatory duties in the background.

There are a number of good examples of integrating a payment card to incentivize customers to become more connected to the brand.

For instance, German’s circular economy pioneer Grover shows how to generate attractive added value for customers by integrating a debit card. Grover, a tech rental platform, wanted to encourage more people to shift to a circular economy and reward this behavior with cashback when using the debit card.

With the branded debit card, Grover has succeeded in improving the user experience and offering value-added services that actively strengthen the customer relationship.

Access to a digital wallet - a win-win situation

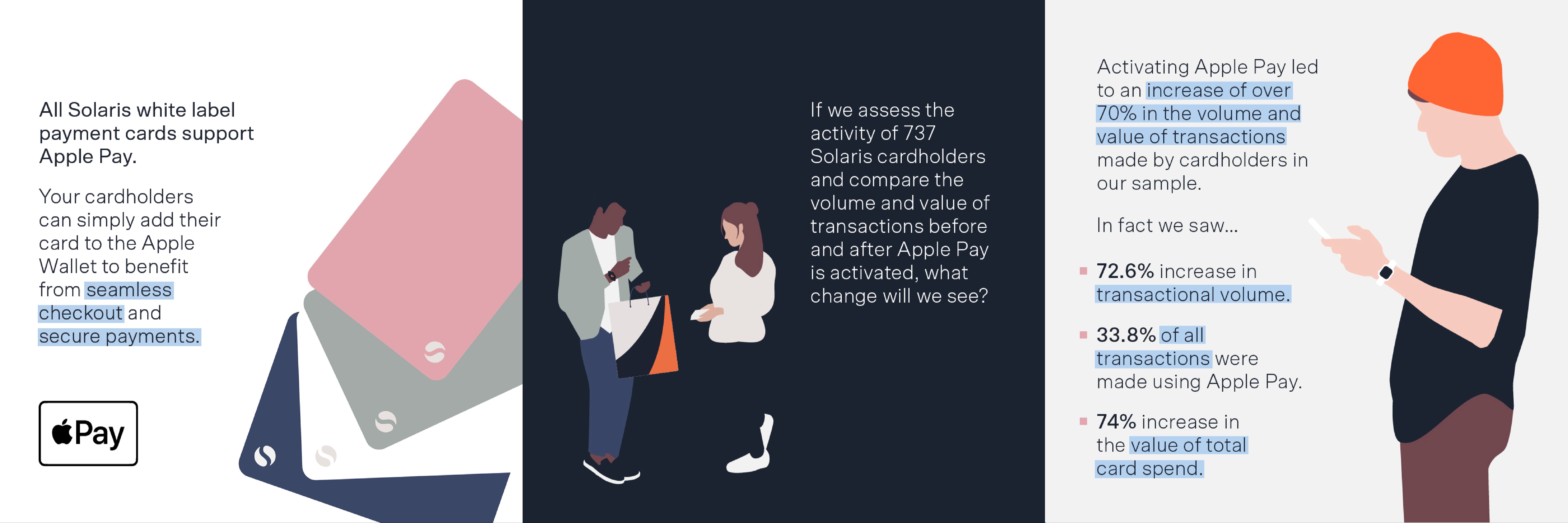

We want to know exactly how access to a digital wallet – Apple Pay – impacts our partners' success when they offer their own payment card.

As soon as cardholders can link their payment card to Apple's wallet, our example shows surprising results:

-

The activation led to an increase of over 70% in the volume and value of transactions.

-

33.8% of all transactions were made using Apple Pay.

-

74% increase in the value of total card spend.

These figures indicate that customers' spending behavior is largely driven by the digital wallet. At the heart of this are user-friendliness, an end-to-end checkout process, and trust in the brand.

This shows that in the last three years, offering a payment card and (at least) a link to a digital wallet has created a major growth area in retail and e-commerce.

Author's note: This article is based on an idea by former colleague James Bessenbach.