In the driver's seat: how embedded finance is re-shaping mobility pt. 1

5 minute read

Few industries have changed as radically as mobility over the past 75 years.

As recently as the 1960s, getting from Berlin to Paris was an eye-wateringly expensive trip that took the best part of a day. Now, with a few swipes on an app, you could be sipping coffee in a café on the Champs Elyseé in under 2 hours, for less than 200€.

But technological advances haven't just improved the speed, convenience, and cost-effectiveness of travel.

Today, mobility providers are increasingly integrated. It's common to start a journey by bus, then switch to the subway, for instance. Or to drive to a park and ride, then use a car-sharing app or bike-sharing app to finish your journey.

More to the point, where the mobility value chain used to be linear, that is the core product — such as an air fare or train ticket — was the main or only source of revenue, that's no longer the case. A growing number of mobility providers have started working closely with other sectors, creating an ever more complex ecosystem.

In 2021, Solaris carried out a research study which identified mobility as one of the most promising — and still largely untapped — sectors for customer adoption of embedded finance.

Following up on that primary research, which focused more on ecommerce, we partnered again with the Handelsblatt Research Institute to explore consumer attitudes to embedded finance in the mobility sector in more detail.

In particular, we wanted to find out from which mobility providers and OEMs customers would be most receptive to using embedded finance products.

In the first of a two-part series, we'll walk you through our findings, and explain why embedded finance is an unmissable opportunity for airlines, train and bus operators, and other mobility providers.

A note on our methodology

To carry out our research, we picked 24 mobility providers in our four core European markets: Germany, France, Italy, and Spain.

We sought to create a mix of mobility brands that are well-known and whose services are widely used throughout each market in our study.

We then conducted a representative survey among consumers in each market to find out:

-

Which of the brands in our list they know about

-

If they use the services of those brands they said they know

-

What key characteristics they associate those brands with

-

How likely they are to use embedded finance products from those brands

Roughly half of the brands in our mobility study were OEMs, while the other half were airlines, inter-city train operators, bus operators, and other mobility-as-a-service providers such as rental car operators and ride-sharing apps.

In this post, we'll focus on mobility operators. We'll discuss OEMs' results and their implications in the second part of this series.

Trust is the most valuable currency in embedded finance

Because embedded finance is a relatively new technology, you'd think customers would be most willing to use products from brands they perceive as innovative.

But while specific target groups do find digital-first players attractive as embedded finance providers — for example, 22% of the German respondents would be willing to get embedded finance products from Tier, one of the brands they ranked highest for innovation — it's not correlated with a greater likelihood of adoption.

Instead, it's security and reliability that have the most persuasive power.

In three of the four markets we researched — Germany, Italy, and Spain — it wasn't even close. Willingness to adopt embedded financial services was correlated most highly with safety and reliability. More significantly, this trend cuts across age groups. Older consumers are just as likely as younger people — and, in Spain and France, more likely than them — to be open to trying embedded financial services, if it's a brand they perceive as being reliable and secure.

This echoes the results of our 2021 study, in which we found that customer loyalty and trust in a brand were fundamental to adoption of embedded financial services in the ecommerce space.

The embedded finance opportunity for mobility providers

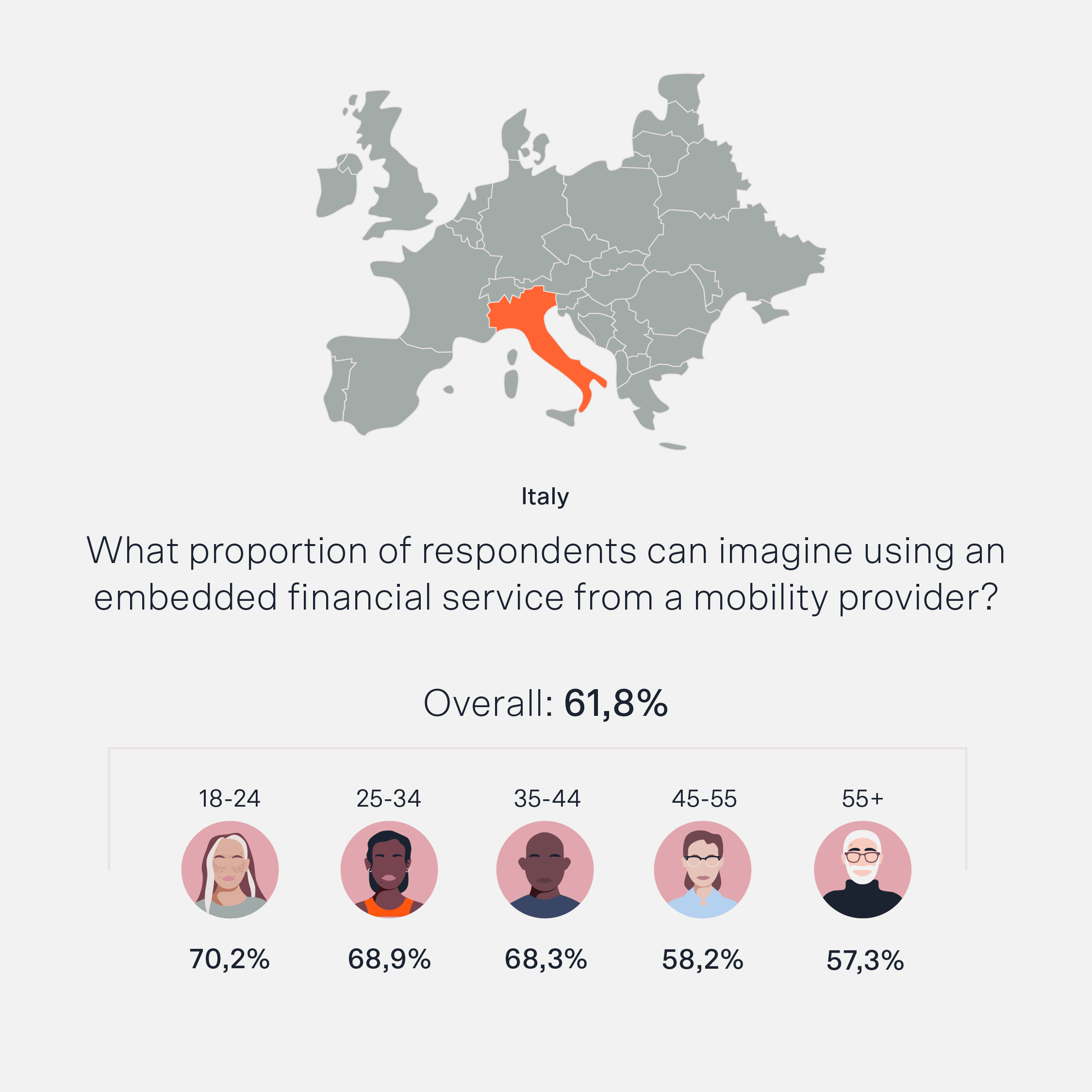

The number of people who can imagine themselves using embedded finance products from mobility providers ranges from a sky high 61.8% in Italy to a promising 33.1% in France.

That said, willingness to try out these products is increasing. And for mobility providers who start offering embedded financial services products today, there's a lot to be gained.

To begin with, embedded finance products give mobility providers access to a large number of valuable data points.

Branded debit cards or credit cards, for instance, could enable them to gain deeper insights into customers' spending behaviors and, in turn, their needs. Which means they can offer a much more personalized service that enhances the customer experience and boosts retention.

The case for this is especially compelling now that cards are becoming more sophisticated thanks to integrations with technology giants like Apple and Samsung, and Banking-as-a-Service providers.

Lufthansa's Miles And More credit card, for instance, is not only a payment method and a loyalty scheme. It also includes travel cancellation and interruption insurance, rental car insurance, and other useful perks for travelers, like international health insurance.

Crucially, embedded finance products are a healthy source of additional revenue mobility providers can use to improve their services and invest in innovation, particularly if they incentivize customers to spend more money on the core product.

While not a mobility provider, Grover, which launched the Grover Card in partnership with Solaris, is a perfect example of this. By using the Grover Card to pay for everyday purchases, customers can earn discounts on Grover tech rentals.

Embedded finance is the key to a more customer-centric mobility industry

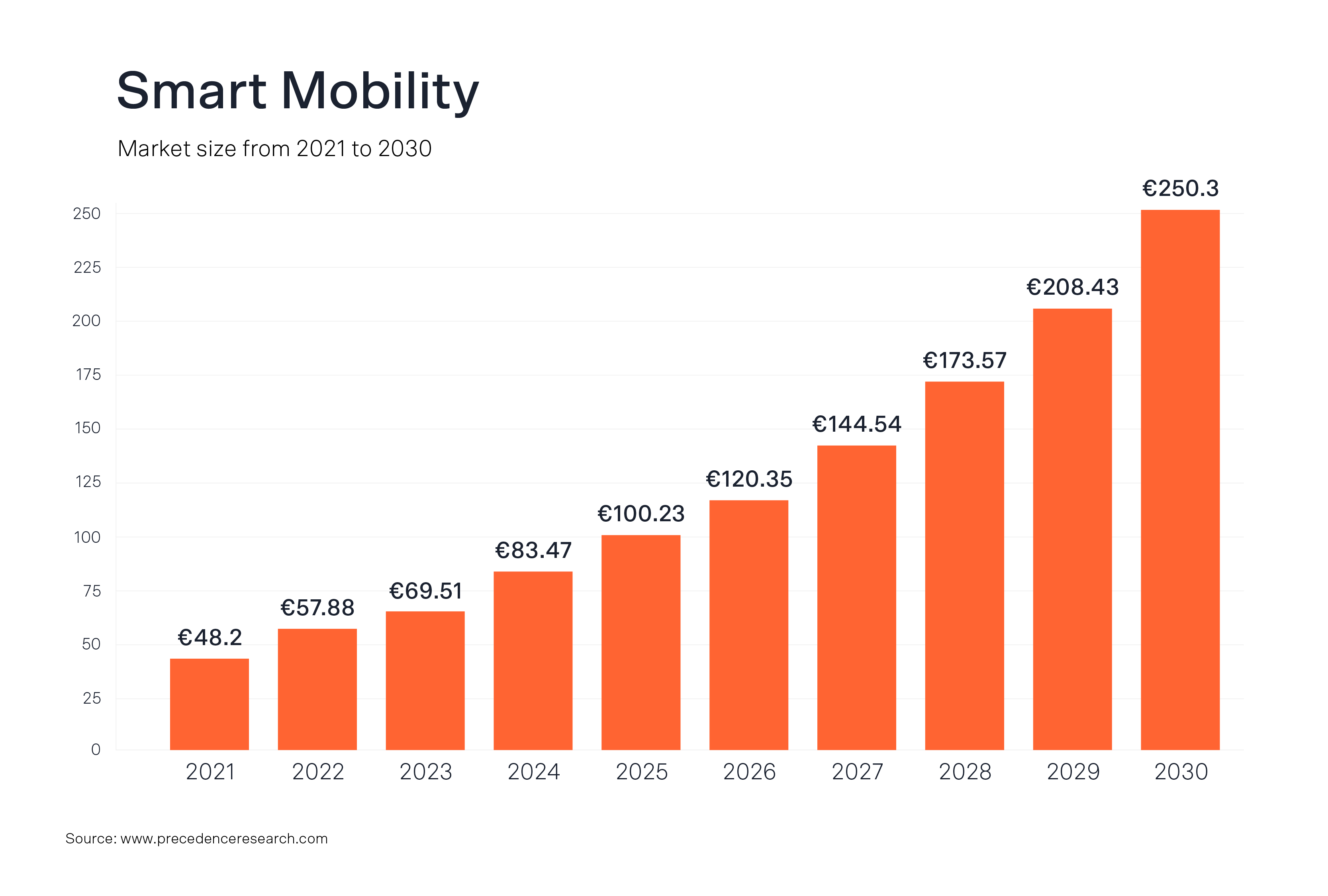

Between now and 2029, the embedded finance industry in Europe is expected to grow at a compound annual rate of 21.4%. And our research makes it clear that mobility is one of the sectors with the greatest potential.

In a world where different ecosystems are ever more integrated, customers expect seamless experiences. And, through embedded finance, mobility providers can offer exactly that: frustration-free payments, valuable perks, and a tailor-made experience that will keep customers coming back.

More importantly, embedded finance can also become a critical differentiator.

eScooter company Lime's digital wallet, for instance, makes it possible to customize your ride, including using local payment methods or having payments processed automatically if you're a frequent rider. This reinforces their 'think like a local' values.

Similarly, Uber — arguably an embedded finance pioneer — has positioned itself as a champion of financial inclusion by launching bank accounts for drivers in Mexico, where 32.2% of adults are still unbanked.

The upshot is that, by doubling down on their core values and investing in embedded finance products to match, established players and younger mobility businesses alike have an unmissable opportunity to stand out from the competition and become even more central to consumers' lives.

Put simply, why would customers need to go to a bank, when their preferred mobility provider gives them exactly what they need?

Want to learn more about the embedded finance opportunity for the mobility industry?

Read the second installment in our series, where we discuss OEMs.