From clay tablets to digital wallets: a brief history of payment cards

6 minute read

From the first ever recorded transaction, cards have always had one key purpose: to make payment as convenient as possible.

But while, traditionally, convenience meant not having to carry around large piles of cash, the benefits of paying by swiping, inserting, or, more recently, tapping your card have evolved with cards themselves.

Today's cards are more than just an easy way to pay for goods and services. They enable consumers to track their spending, save money on exchange rates, and earn loyalty points, discounts, and other exclusive perks.

As a result, they're an unmissable opportunity for businesses across all industries to stand out in a crowded market, strengthen their customer relationships, and build valuable new revenue streams.

Here's a brief history of cards and a look at why, if you're a business, there's never been a better time to consider issuing your own branded payment card.

The early days: everyone owes everyone

Diners' Club is often credited with being the first "true" credit card. But cards are actually much older.

Records dating back 5,000 years show that, in ancient Mesopotamia — incidentally, the Mesopotamians also invented banking and accountancy — it was common practice for traders to record transactions on clay tablets.

These tablets proved that a person had supplied goods to another party and was owed X amount of money in return, so they could be used as promissory notes. To use modern terminology, they enabled somebody to buy now and pay later.

Credit cards didn't evolve much over the next few millennia, but credit boomed.

Between the Middle Ages and the early 1800s, it didn't matter if you were a royal or one of the poorest in society. European consumers rarely paid for goods and services immediately. Most of the time, merchants kept tabs on who owed how much and why, and people paid back what they could when they had money.

By the 1400s, it was normal to be deeply in debt or owed large sums of money. When an Englishman called Thomas Frost passed away in 1421, for instance, a whopping 92% of his £76 estate — around 63,581€ in today's money — consisted of debts owed to him.

1960: A spot of ironing sparks a payment revolution

In the late 1800s, credit terms — and credit cards — started to change. Customers could still run tabs with their favorite shops, but they had to settle their balances at the end of the month.

Large department stores in the US also started issuing customers with personalized cards they could use to buy on credit up to a certain limit. These proved extremely popular. And, before long, merchants in other industries were issuing cards too.

The most famous of these cards is, of course, Diners' Club, which enabled holders to eat at restaurants across the US on credit. Other schemes soon followed. American Express, for instance, issued the first travel-and-entertainment card — a card that holders could use to pay overseas.

But it's a woman called Dorothea Parry who helped make credit cards what they are today.

In the late 1950s, the CIA tasked IBM with creating staff ID cards that could store data. Engineer Edward Parry had the idea of recording the data on pieces of magnetic tape that would be glued to the cards. Except every glue he tried warped the tape and made it unusable.

One night, Dorothea, his wife, suggested ironing the tape onto the card instead of glueing it.

The idea worked beautifully, and the rest is history.

The road to ubiquity

The magstripe was to payment cards what the wheel was to transportation.

Where, previously, merchants had to meticulously record every transaction by hand, customers now just had to swipe their cards and sign their names.

The magstripe — and other technologies that made it possible for point of sale terminals to communicate with banks — also opened new possibilities.

Payment cards no longer had to be credit cards. The first debit cards, which enabled customers to pay from the available balance in their bank accounts, are thought to have appeared in 1966. And prepaid cards followed soon after.

Over the next few decades, technological developments continued to make cards more convenient and safer to use.

German engineers Helmut Gröttrup and Jürgen Dethloff came up with the idea of storing card information on electronic chips, which led to the development of chip-and-pin technology.

Then, contactless technology made it possible to pay simply by tapping your card against a point of sale terminal. And, at the same time, online wallets made it possible to store card details digitally, enabling you to pay by card even when it physically isn't in your wallet.

Germany's slow road to card acceptance

While the simplicity and convenience of cards has made them exceedingly popular in the UK and much of northern continental Europe, Germany has had a harder time embracing them.

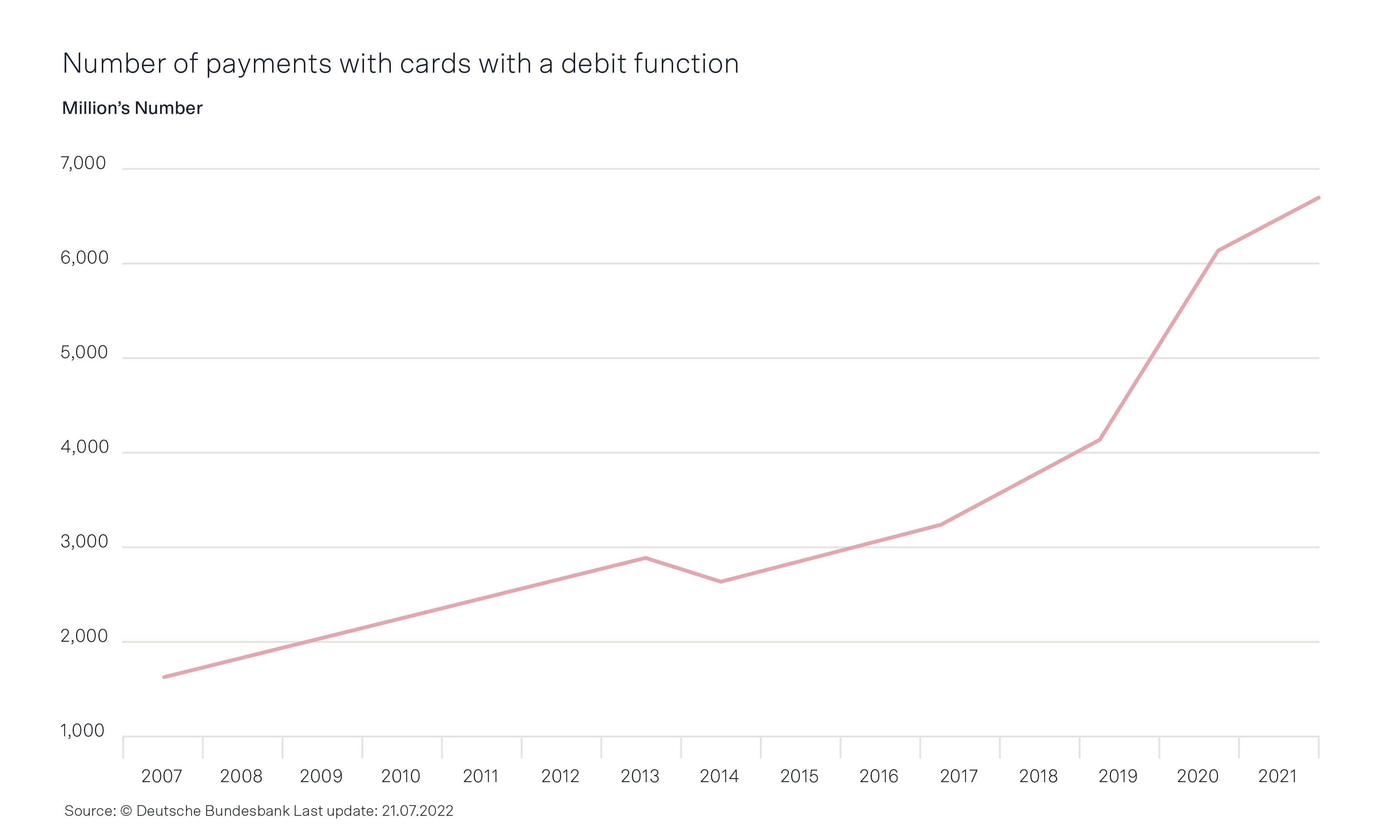

In 2019, Germans paid by card only 12% of the time. In comparison, 51% of UK transactions were paid by card. Similarly, consumers paid by card 60% of the time in Sweden, and 65% of the time in Finland.

But, just as it was looking like card payments would never gain critical mass, the Covid-19 pandemic hit and changed everything.

With mounting concern that touching notes and coins would help the virus spread, Germans started switching to cards.

The authorities also took steps to make card payments easier, by raising the contactless limit from 25€ to €50, while many merchants promoted contactless payments or implemented card-only checkouts.

As a result, card payments spiked.

In 2020, 30% of all transactions were paid by card — more than double the amount in 2019. And in 2021, card payments outnumbered cash payments for the first time ever.

More significantly, research suggests the switch is becoming permanent. In a German Payment Systems Initiative study, 44% of respondents said they planned to continue paying by card, even after the Covid-19 pandemic.

Catching the wave: Why there's never been a better time for businesses to launch their own branded payment cards

It's not just consumers' preferences that have changed over the past two years. The German retail landscape has also shifted.

The Covid-19 pandemic and rising cost of living have hurt sales.

On the bright side, embedded finance technology has made it possible for any brand to offer financial services products — including branded credit, debit, and prepaid cards — without having to obtain a financial services license or pivot part of their operations towards financial services.

And that means consumers' newfound affinity for card payments couldn't have come at a better time.

Whether you're an e-commerce retailer, a travel platform, a mobility provider, or even a business in another industry, launching your own branded payment card has three compelling benefits.

1. Stickier customer relationships

Offering a card means that, alongside your core business, you're also an essential service your customers use on a daily basis. And this enables you to increase the number of touchpoints in an endless number of ways.

- Case in point, you could; Make it easier for customers to manage their money through in-depth spending analytics

Or you could link cards to a loyalty program and use transaction data to ensure offers are tailor-made to individuals' unique preferences.

These are just two examples of valuable incentives that boost trust and keep customers coming back. US retail giant Best Buy, for instance, say their credit card is their second biggest driver of repeat business.

2. Build a new revenue stream

With Solaris' card issuing model, you get a portion of the interchange fees on every single transaction customers pay with your card.

You can also monetize card data by offering customers personalized offers. Or you could expand into loans and other credit products.

3. Reinforce your brand

Customers will interact with your brand even when they aren't buying from you. You can customize your cards with your branding and logo, so you'll be front of mind every time they pull out their card.

Issuing your own cards also opens up other brand-building opportunities. Sustainable mobile banking platform Tomorrow, for instance, which issue their cards in partnership with Solaris, protects 1m² of rainforest from deforestation whenever a customer pays at least €1 with their card.

To date, Tomorrow's users have protected 165 km² of rainforest, simply by tapping their cards.

Looking ahead: what's in store for payment cards?

Payment cards have come a long way since the days of ancient Mesopotamia. From humble promissory notes on baked clay tablets, they've become digital powerhouses that are central to consumers' financial lives.

But the evolution is far from over.

Already, customers can change their PINs, freeze or replace lost or stolen cards, and control what their card can or can't be used for — including setting spending limits — with a few swipes on an app.

Over the next few years, cards will likely also get smarter, with AI integrations giving tailor-made recommendations and making it easier to stay on top of spending.

More to the point, in an increasingly tough retail landscape, they're an invaluable customer retention tool.

By combining attractive perks with highly personalized, relevant features, merchants can create an irresistible offering that adds value, boosts revenue, and keeps customers coming back.