Adventure awaits: The embedded finance opportunity for tourism

7 minute read

It's back. After a devastatingly tough two years, the tourism industry is on the up.

In the first quarter of 2023, international arrivals in Europe reached 95% of 2019 levels. By the end of the year, global revenue is expected to hit $9.5 trillion (around €8.9 trillion) — just 5% under 2019 figures.

But while the sector's recovery is good news all round — for airlines, for the hospitality industry, for online booking platforms, and, of course, for travelers, who can go out and explore new places once more — new challenges have emerged.

Rapid digitalization in the wake of the Covid-19 pandemic has re-shaped consumers' payment habits and expectations. At the same time, the cost-of-living crisis has shifted their priorities, making them more careful about how and where they spend their money.

So, what does this mean for the tourism industry moving forward?

Sustainability and value-for-money are travelers' top two priorities

With record inflation and skyrocketing global temperatures dominating the news, it's no surprise that travelers are increasingly keen to get as much bang for their buck as possible while minimizing their carbon footprint. There are three key consumer behaviors that are shaping demand:

- A growing preference for staying within Europe and, specifically, for visiting the cooler parts of the continent, such as Germany, Switzerland, Scandinavia, the Netherlands, and the UK

- A desire for experiences. In particular, more and more tourists are seeking out lesser-known destinations and immersing themselves in the local culture

- Bargain-hunting. This is true across the board, but especially so in countries where real wage growth remains stubbornly negative

Tourism companies who offer embedded finance products are ideally placed to meet these evolving expectations and bring in more business.

Buy-now-pay-later is the obvious way to go, because it incentivizes consumers by giving them the flexibility to split the cost of their holiday into a number of convenient installments, so it's more affordable.

But, from a value-for-money perspective, branded credit or debit cards are an even more powerful way to strengthen relationships with current customers and attract new ones.

Branded cards linked to a loyalty program aren't a new concept in the tourism industry. British Airways, Lufthansa, Hilton, and many other well-known brands have been offering them for years.

The advantage of embedded finance is that the operator owns the product and the data, so they can offer highly relevant, personalized rewards based on the individual consumer's purchase history and preferences.

"Rewards programs are enduringly popular. Everyone likes free stuff, right?" observes Solaris' Business Development Manager Darren Lane, "Except, historically, in the tourism sector, they've been somewhat elusive. How many times have you actually managed to redeem your air miles?"

"It sounds cliché, but it really is a space that's ripe for disruption. You could bundle VIP lounge access into your card… or fee-free foreign transactions, for instance. Small things, but they make a tangible difference to the travel experience. And once you've built them into your customers' expectation of what a holiday should be like, they're more likely to stay loyal."

Cards also create opportunities from a sustainability perspective. Digital bank Tomorrow, for instance, protects 1m² of rainforest from deforestation for every €1 consumers spend on their card.

Tourism operators could take a similar approach, pledging to offset carbon emissions or offering consumers the option of rounding up their purchases, with the extra money invested in projects with a sustainability or environmental focus.

Credit cards are catching up to cash as a payment of choice while abroad

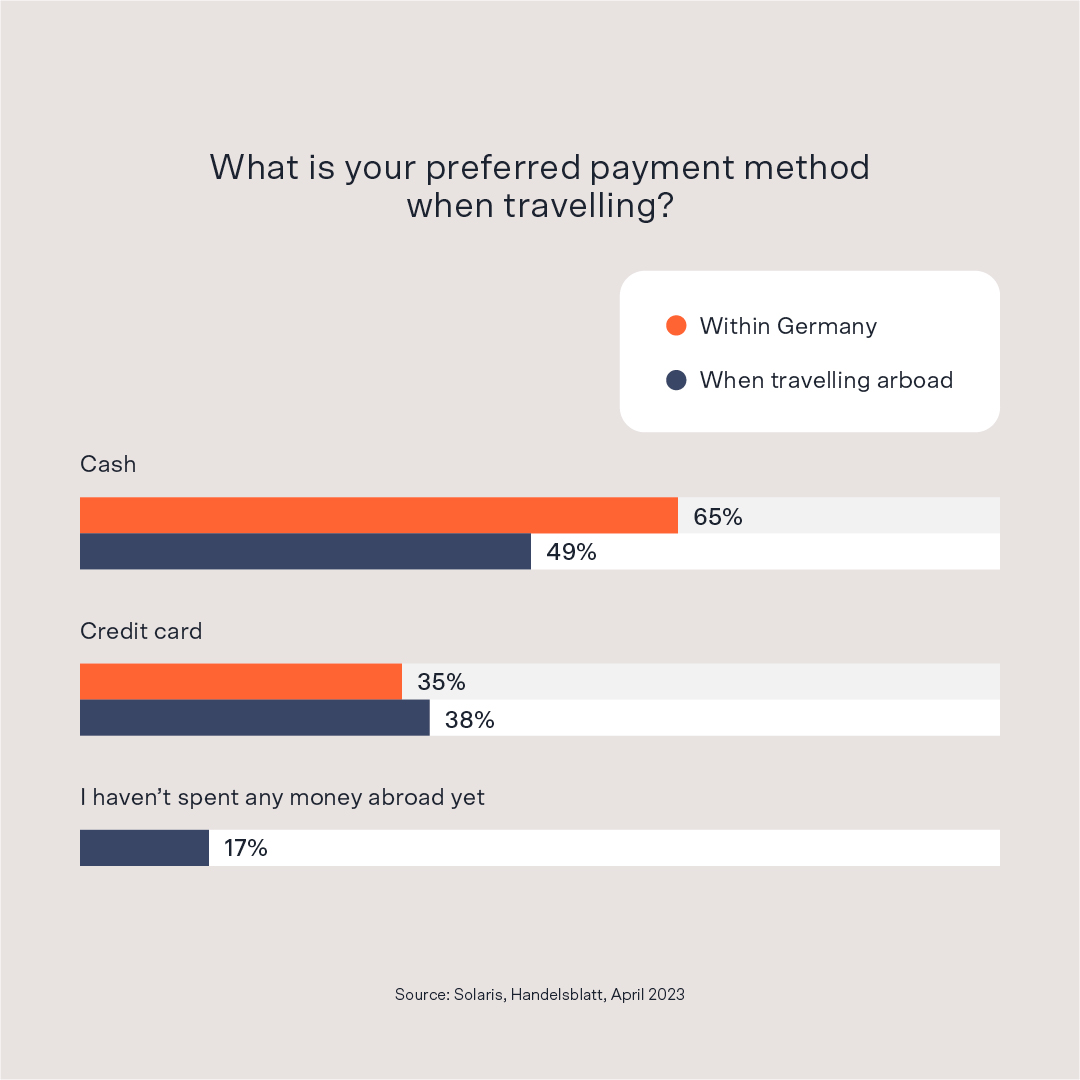

The case for issuing branded cards is all the more compelling when you consider that growing numbers of travelers are using them on holiday.

While more than 40% of Germans in every age group prefer to pay in cash when abroad, credit cards are the second most popular payment method, with 38% saying it's their preferred choice.

Credit cards are most popular among men (42%) and 35-to-44-year-olds on higher incomes (39%). But people are using them across the board. 34% of women pay with credit cards when traveling abroad. And, across all age groups, credit card use is always at least 35%.

Given Germans' famous predilection for cash and their dislike of credit, this is a surprising development. And one that is very positive for tourism operators.

For one, cards create opportunities for the customer to interact with the brand even when they're not booking a holiday or traveling: at their local coffee shop, at the grocery store, when shopping online… The list goes on. These continuous, consistent interactions can develop into a healthy stream of additional revenue, and also pay off down the line in the form of greater trust. Case in point, because Lufthansa's Miles and More program is so well-known, consumers are more willing to use their credit card than one from other mobility providers.

What's more significant, though, is that one of the key reasons travelers are ditching cash for cards is so they can log onto their banking app and keep an eye on their spending.

Integrating budgeting features into an app creates further touchpoints with the consumer. There's also an opportunity to link budgeting features with rewards that further increase consumer satisfaction and trust, such as discounts and cashback or even custom itineraries built around the customer's preferences.

Tourists are already open to buying financial services from tourism operators

The benefits of offering embedded finance products — increased revenue, greater customer satisfaction, more brand loyalty — are undeniable. But how strong is the demand for these products from travel operators? How many travelers are actually prepared to make use of them?

Our research — a representative survey of 2,020 consumers conducted in conjunction with the Handelsblatt Research Institute and YouGov Deutschland GmbH — puts the number at one-fifth, or 20% of respondents.

At first glance, this might seem too small to be significant. Until you consider that, in Germany alone, consumers took 67 million holidays — trips involving travel and lasting at least five days — in 2022, while international arrivals to Europe totaled 595 million.

The upshot is that the potential addressable market is huge.

Consider AirBnB. Around 150 million people worldwide use the platform. If just 20% were to use an AirBnB-branded card, that would be 30 million consumers.

But our research suggests the number of consumers who are open to using a branded credit card varies by brand (more on this in a minute). In the case of AirBnB, that number is 31% — 46.5 million customers. To put that in perspective, there were 121.3 million debit cards in circulation in the whole of Germany in 2021.

More to the point, because embedded financial products are presented to the customer at the point of need, they have higher conversion rates. 41% of consumers choose embedded finance products precisely because they're easier to obtain than traditional products from an incumbent.

Most tourism operators also have strong customer databases they can draw from to build highly personalized and compelling offers.

Big brands have a competitive advantage, but only in theory

Unsurprisingly, given that consumers are more likely to trust a brand they're familiar with, there's greater openness to trying embedded finance products from large, well-known brands.

When it comes to online booking platforms, for instance, consumers are most willing to try embedded finance products from TUI (74%), Booking.com (71%), and Trivago (60%). As for hotel chains, Hilton tops the list at 69%, followed by Best Western and Marriott, both at 62%.

But while these numbers might give the impression that smaller players who wish to offer embedded finance products face an uphill struggle, Darren Lane argues it isn't a foregone conclusion.

"First," he explains, "I think it's important to keep in mind that brand loyalty is changing. Younger generations aren't loyal to legacy brands like British Airways or Hilton. They're loyal to the brands they interact with on a day-to-day basis. And those are Apple, Google, Amazon, and other digital-first brands."

"Second, you'd typically offer embedded finance products to somebody who is already a customer, not to people who don't know your brand. From this perspective, I think the numbers are reassuring, because they confirm that, if you already have a connection with the customer, they're going to be more receptive to buying embedded finance products from you."

Travelers are keen to receive additional benefits

By offering value-added services that benefit all tourists, no matter their destination, tourism providers can draw in additional customers.

Benefits could include providing travel and accident insurance, travel perks such as lounge access and favorable FX rates when spending abroad, or even creating a loyalty program that rewards travelers for visiting certain sites or restaurants on their adventures.

43% of respondents told us they'd like to see travel health insurance as a perk offered by their financial services provider, while 42% would like to see travel cancellation insurance. And 31% would enjoy insurance that covers them while driving their car abroad.

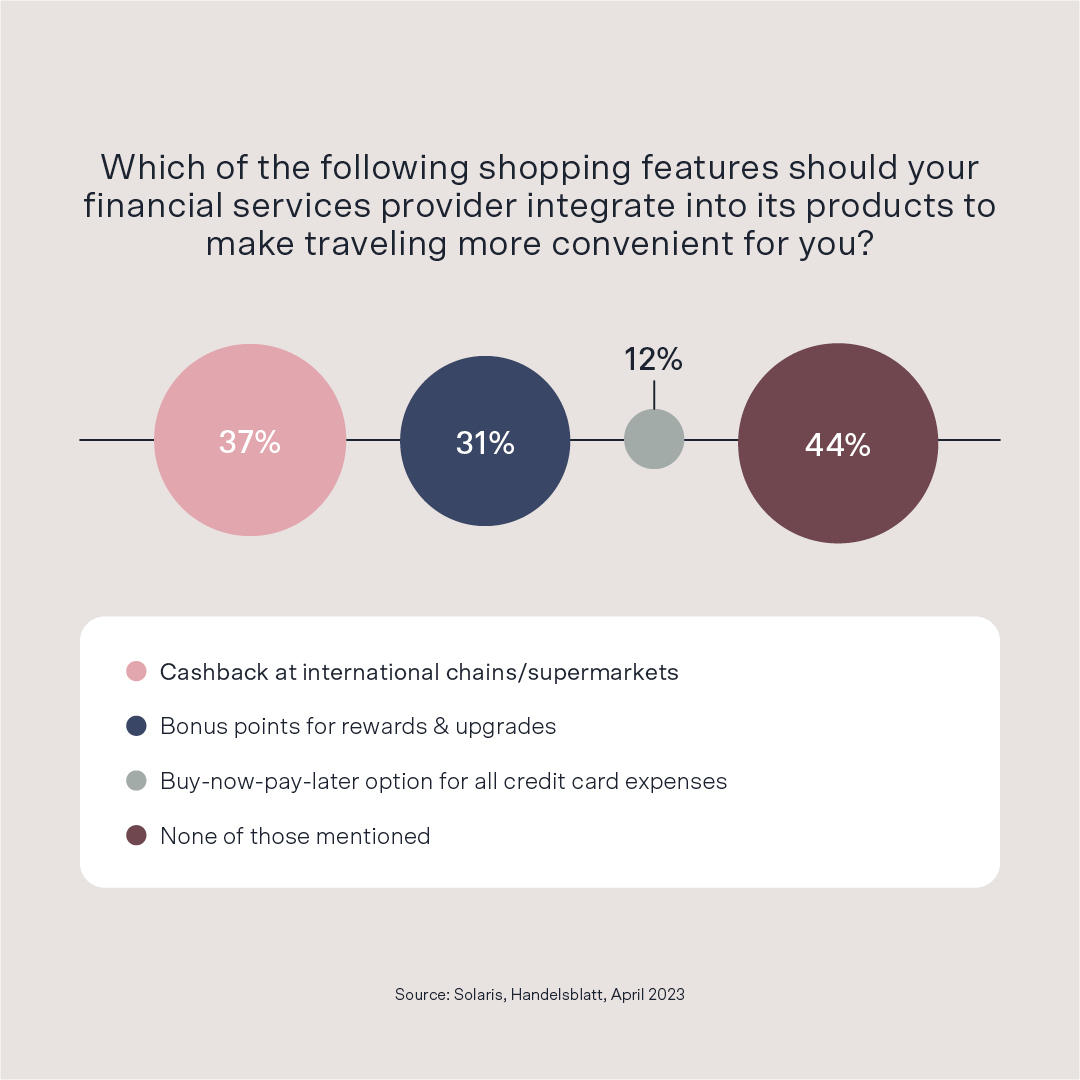

There’s also strong interest in other products. 56% want cashback, bonus points, and upgrades. And 37% want cashback specifically from multinational retailers such as budget supermarkets ALDI and Lidl — further proof of how budget-conscious travelers have become.

Looking ahead: Making travel a safer, smoother, more luxurious experience for all

While the tourism industry is in the best shape it's been since the high peak of 2019, airlines, hotels, and operators can't afford to be complacent. Yes, people are as keen to travel as they've ever been. But their mindset has changed radically in response to digitalization, the uncertain economic landscape, and the increasingly worrying state of the climate. And that means operators have to adapt in order to thrive.

Embedded finance is an opportunity to do just that.

By offering tailor-made financial services products at the point of need, tourism operators can make their offering more valuable than ever before. They can enable consumers to indulge without breaking the bank. Empower them to address their sustainability concerns, including by minimizing or offsetting their carbon footprint.

Most of all, they can stand out by offering benefits that, while potentially small, make a tangible difference to the customer experience.

"I think, in tourism, it's often the case that there's great service up to the point where you book… and then issues start to crop up," concludes Darren Lane. "So there's a real need and a real opportunity there."

"When you give the consumer a tangible benefit — saving them money, giving them more flexibility, or an insurance product they can fall back on if things go wrong — it's far easier to earn their continuing loyalty and trust."