Closing the gender gap: Making fintech more inclusive

8 minute read

European fintechs founded or led by women closed some of the most headline-grabbing funding rounds of 2022.

Yoko Spirig's equity management platform Ledgy, for instance, raised $22 million (around €20.5 million) in series B funding.

Similarly, Georgia Stewart's shareholder voting platform Tumelo raised $19 million (around €17.7 million) in series A funding, while Swiss spend management platform Yokoy, co-founded by Melanie Gabriel, raised $80 million (around €75 million) in series B funding.

These numbers make it seem like women in fintech are finally getting the recognition and funding they deserve.

Until you realize that fintechs with leadership teams made up entirely of women:

-

Raise, on average, 57% less money than teams made up entirely of men

-

Typically raise half as much money in subsequent funding rounds than they do in early-stage rounds

-

Received only 1.9% of all fintech venture capital funding available in 2022 — less than the 2.4% they raised in 2021

The numbers aren't much better for mixed leadership teams — teams made up of both men and women. Unconventional Ventures, a VC firm dedicated to funding fintechs led by women and diverse teams, estimates that at least 85% of all fintech funding goes to teams that are entirely made up of men.

Women of color and from other minority backgrounds have it worst, getting the smallest slice of the funding pie overall.

In 2020, they received a measly 0.35% of all available VC funding. Given that the slice of VC funding received by fintechs founded or led by women is shrinking year on year, it's likely that women of color and from other minority backgrounds received even less funding in 2022.

Representation matters

Lack of representation is a big part of the reason why fintechs founded or led by women get so little funding and, in turn, why so few women take the plunge and start their own firms.

In Germany, for instance, you're more likely to find a man called Thomas than a woman in the boardroom.

Similarly, according to Unconventional Ventures, 77% of venture capital firms have decision-making teams made up entirely of men. And the few women in decision-making roles typically have less funding to give away than their colleagues who are men.

This pervasive lack of representation has created a vicious cycle.

Research has found that, because they don't see themselves represented in leadership teams, women often have low expectations of success. This discourages many of them from even trying. For example, only 34% of European STEM (science, technology, engineering, and mathematics) graduates are women.

As for those women who still decide to work in fintech or found their own startups, the overwhelming likelihood is that they'll be facing leadership and VC funding teams that are made up entirely of men or predominantly made up of men.

When asked what needs to change in the financial industry to ensure that women and non-binary people have better access to jobs, opportunities for advancement in financial institutions, and funding, Claudia Rasper, Partner at BCG, responded the following:

Ultimately, we need to change two things: First, we need to address everyone's unconscious biases to confront prejudices and false/inappropriate expectations that lead to career barriers for women and non-binary people. Secondly, we need to challenge current career paths and work environments that have been developed based on the realities of primarily white men and may not align with the preferences and realities of at least the other half of society.

Here again, research reveals that people are most likely to help somebody who looks like them. In the context of VC funding — and in the workplace — this means men are more likely to give money or a promotion to another man.

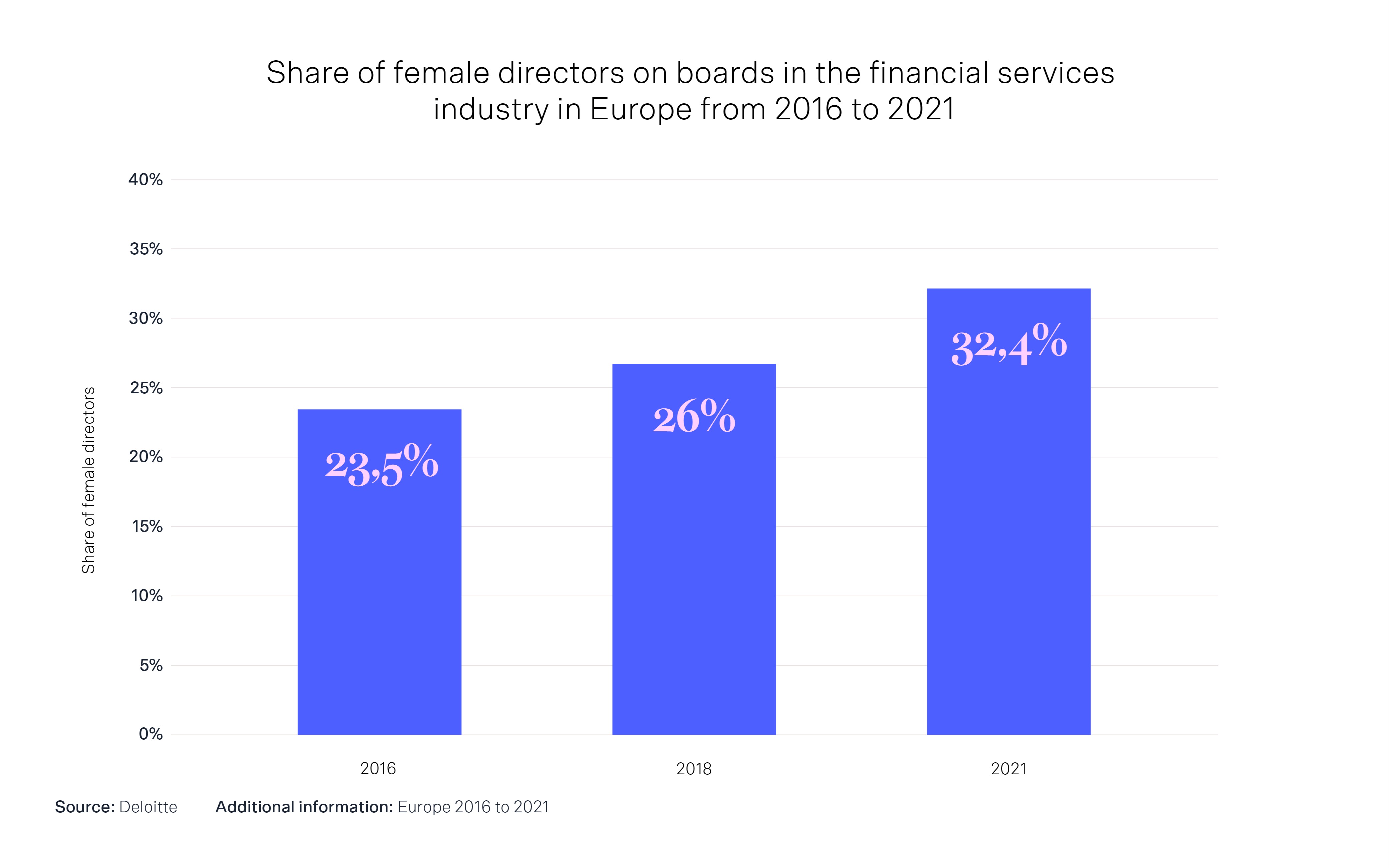

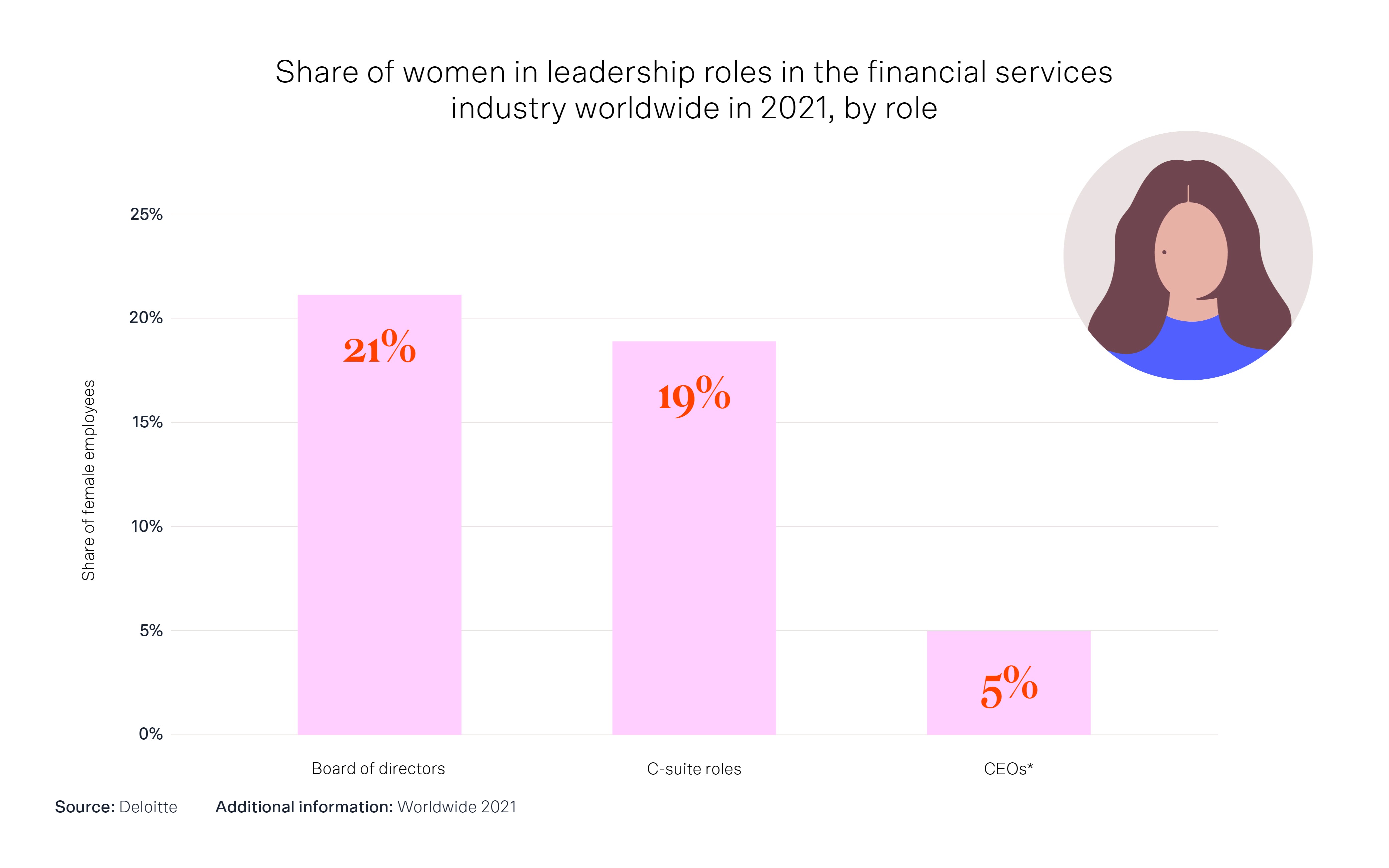

Of course, the opposite is also true, and a woman is more likely to help another woman. But since there are much fewer women in leadership positions than men — and they have less money to give away — women have nowhere near the chances of success that men have.

Fighting unconscious bias

While ensuring greater representation is key to leveling the playing field for women — especially those from minority backgrounds — it's not an easy fix.

For starters, research consistently shows that women have a harder time being taken seriously.

In a 2012 study, for instance, men were rated as significantly more competent and hirable by both the men and the women who took part in the study, even though the CVs they were given to review were identical except for the names.

And, in another study, two thirds of women reported having their expertise questioned and being repeatedly asked to back up their claims, with the number shooting up to two-thirds for women of color.

These two studies relate specifically to women in STEM. But these biases will be familiar to women in any industry.

Tijen Onaran, CEO & Founder of Global Digital Women, sums up why women are seen as less competent - especially by their male colleagues:

Women are judged differently than men because the socialization of women is different from that of men. From childhood on, women are told: not too loud, not flashy. We have to change that! So that women don't get the feeling that they have to become the better men, but they can simply remain themselves and still follow their career path.

While most people wouldn't admit to believing women aren't good enough — not even to themselves — the reality is that the onus is usually on women to prove they're competent and that they belong.

These biases often become internalized, which affects confidence.

For example, an often repeated statistic states that most women won't apply for a job unless they meet 100% of the requirements, while most men will apply even if they only meet 60% of them.

Even when they get hired, women invariably face an uphill struggle.

Case in point, women are more likely than men to be saddled with caring responsibilities. So, because of the way many workplaces are structured, it's often difficult or impossible to do certain things that would enable them to advance their careers, like attending early-morning or late meetings, or the after-work events where their colleagues (mostly men) forge invaluable professional connections.

These challenges can hamper women's ability to advance their career at the best of times, but even more so during times of social or economic upheaval.

Research from BCG, points out, that black female leaders were judged more negatively than black men and white women when the companies they managed failed.

In addition, women of color have yet to overcome the challenges of the Covid 19 pandemic, such as increased caregiving responsibilities and fewer opportunities to connect with seniors or mentors than white women.

The proportion of women of color who reported that the pandemic negatively impacted their work-life balance (41%) was higher than the proportion of white women (28%) who noted the same impact – a clear sign of how biases impact marginalized groups in crisis situations.

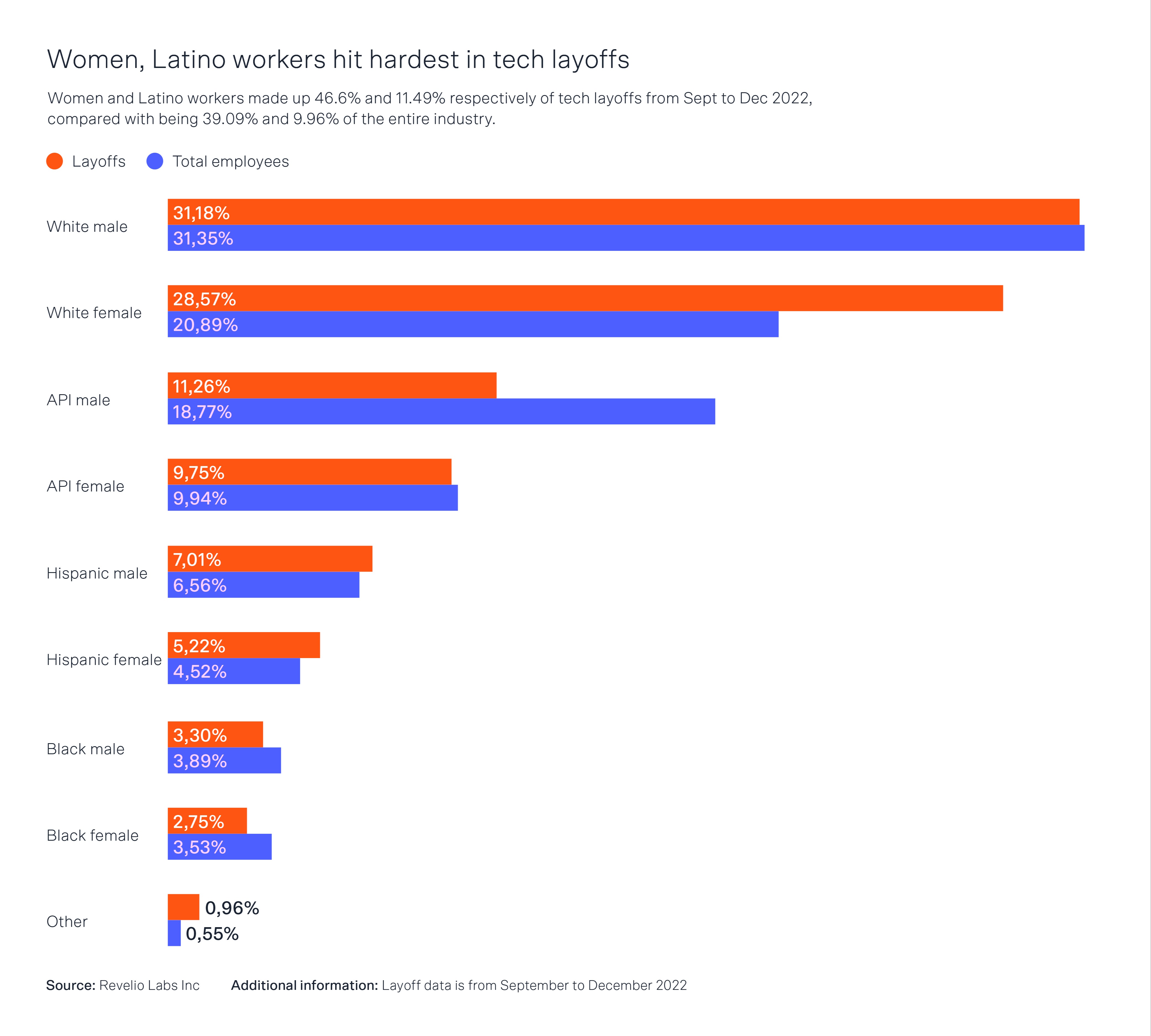

The upshot is that, inevitably, women are disproportionately affected by layoffs. Despite making up only 39% of the global tech workforce, for instance, 46.64% of people who were laid off in 2022 were women.

Structural biases also mean that the majority of women and people from underrepresented minorities are hired to fill roles — like HR, marketing, or low-level tech jobs — that are perceived as more "dispensable".

Ironically, women were hardest hit by layoffs in companies that pushed for more diverse hiring in 2021 and 2022. Here, the "first in, last out" principle meant women and other underrepresented minorities were the first to go.

Putting in the work: what Solaris is doing to make fintech more inclusive

In 2022, we decided it was high time somebody took proactive steps to kickstart change in the fintech industry, so we founded Futura, a network to support and empower women.

Our initiative has two key aims: making Solaris a more attractive place for women to work, and, more importantly, setting an example for the rest of the industry.

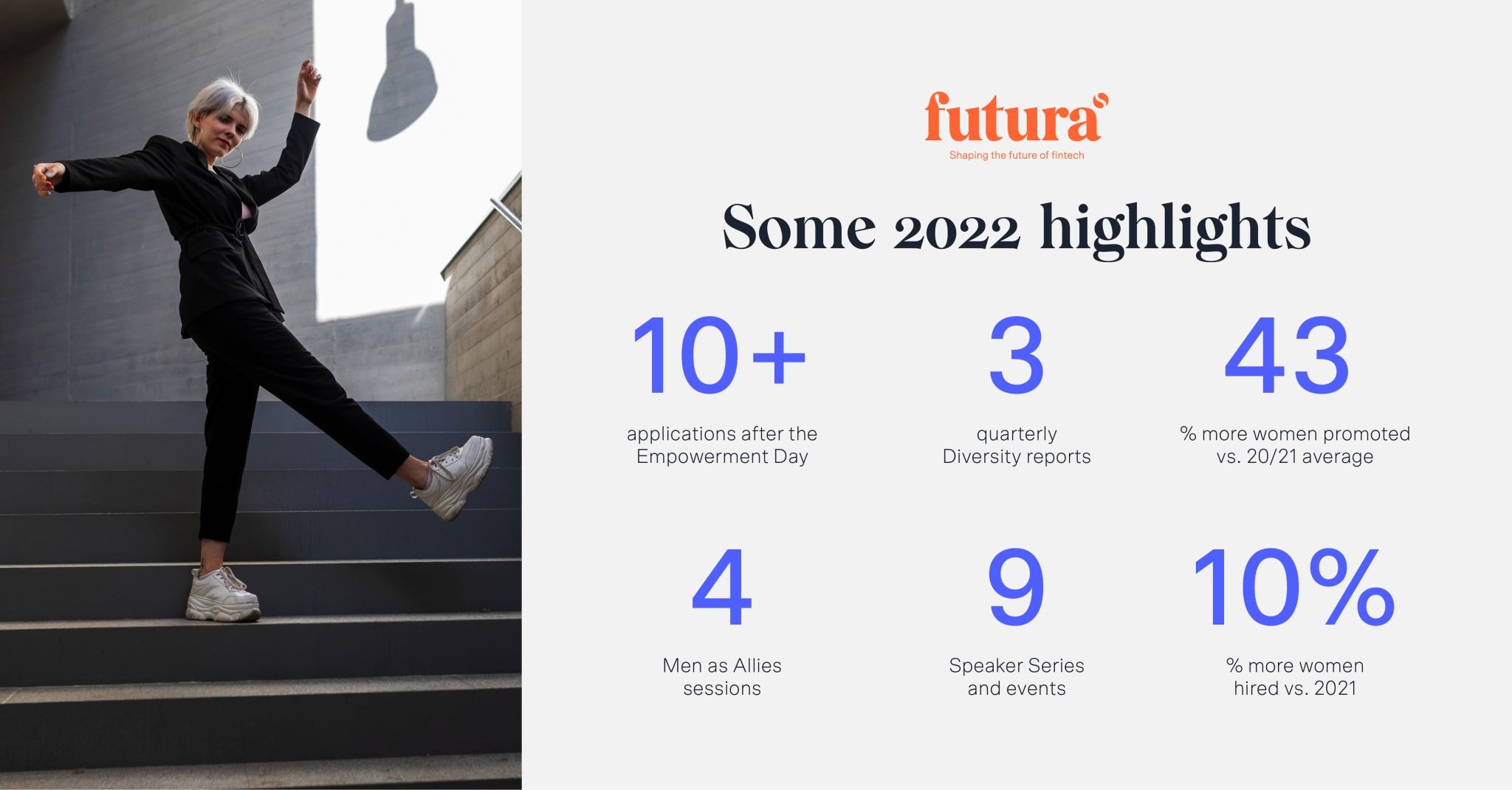

Over the past year, we've launched over twenty initiatives. These included nine speaker series events, where women in leadership roles shared their experiences and lessons learned, and four "men as allies" sessions, where we engaged with leaders who are men in open and honest conversations about what's holding women and other underrepresented groups back, and how we can address these issues.

We also held leadership accelerators where participants were 50% women and 50% men, as well as sponsoring awards and events aimed at increasing the visibility of women, such as the Digital Female Leader award and Focus Money Female Finance Award.

Another highlight of our work was Empowerment Day, in which we brought over 100 women from across the industry together to learn from each other, forge those all-important professional connections, and discuss best practices, shared challenges, many other interesting topics you missed out on if you weren’t there.

We also made sure we walked the talk.

Every quarter, we've been publishing a report that highlights our gender diversity to keep ourselves accountable. The data we track and publish includes the rate at which we hire and promote men and women, and the rate at which men and women leave the company (attrition).

This data has been instrumental in helping us identify and proactively address our internal biases. And the changes we have put in place as a result have enabled us to hire 10% more women and promote 43% more women in 2022 than we did in 2021.

Diversity and inclusion benefit everyone

In a 2020 study, companies with diverse leadership teams outperformed companies whose leadership teams were made up entirely of men by 25%.

Fintechs with leadership teams made up entirely of women and fintechs with mixed-gender leadership teams are also twice as likely to have positive social and environmental impacts in their communities, which means they score highly on those all-important ESG metrics.

But the case for making fintech more inclusive isn't just in the numbers. Diversity matters because it enables fintechs to become better at what they do.

Although diversity and inclusion contribute to better team performance, we asked Andrea Fernandez, Co-Founder & CEO of Vitamin, how this affects seemingly "gender-neutral" products such as banking and financial services, and whether women need specific financial products.

Regrettably, up until now, there has been very limited progress from a diversity and inclusion perspective in creating a fair and unbiased financial system. The financial industry has been dominated by men, who have had mostly a man as a target user in mind leading to the creation of products that don't serve everyone equally. Women have unique financial needs and in order to develop products that serve them well, those needs must be taken into account in the product development process. Building diverse teams is therefore essential in creating products that are best fit to users' needs and that result in a more inclusive and fair financial system that helps everyone build stronger financial futures

When all the people on a leadership team come from similar backgrounds, their thinking risks becoming stagnant.

Companies that don't have a diverse workforce also risk becoming extremely unattractive to job seekers. Under 40s in particular are actively avoiding companies that don't have a clear commitment to promoting diversity and equality.

By contrast, bringing in people with different perspectives and lived experiences enables companies to empathize with a wider cross-section of customers. And that means their products and services will be much better at serving the needs of those they're intended for.

To put it another way, a diverse workforce and diverse leadership enable companies to better represent their customers, be better role models, and, ultimately, build products that promote parity and inclusion instead of perpetuating injustice, inequality, and negative stereotypes.

As for Futura, we're planning even bigger and better things in 2023, including a six-month top talent development program that includes job-shadowing, so bright and promising women can get much-needed face time with senior leaders who could offer them career opportunities down the line.

We'll announce more details about this program and other upcoming Futura events shortly.

In the meantime, if you're keen to make a difference in the financial services industry, but also value flexibility and being able to bring your whole self to work, we'd love to chat.